TABLE OF CONTENTS

Leader resume summary examples

Most hiring managers only do a seven-second scan of your resume. If they don’t see what they’re looking for in your professional summary, they’re probably skipping to the next person.

A professional summary is a two-to-three-sentence paragraph that sells your top achievements as a Leader and best qualifications for the job at hand.

Recent grads, career-changers and those without much work experience would be better served by writing an objective statement which mentions your goals for a position and the skills that you do have.

Below, we’ll share examples of Leader professional summaries for different job candidates.

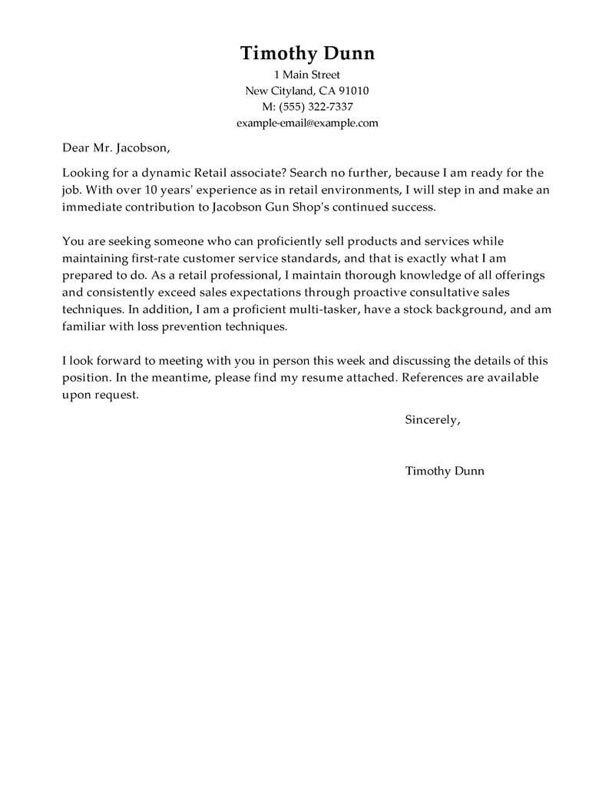

Good example:

“ An experienced leader with over 10 years of success in driving operational excellence and developing high-performing teams. Proven ability to deliver results with a focus on efficiency, customer satisfaction, and cost-effectiveness. Skilled in identifying and implementing process improvements that increase productivity and reduce costs.”

Why this example passes:

- Feature candidate’s success statistic to grab attention. Numbers add detail about how big the results you deliver are, e.g., test scores, passing rate and more.

- Shows career length, 11 years.

- Mentions employer-desired skills: student motivation and interactive lessons.

Bad example:

“ I am a leader with a strong background in managing teams. I have experience in working with different types of people and am able to work in a fast-paced environment. I am a great communicator and have the ability to think outside the box.”

Why this example fails:

- Doesn’t include any numbers that quantify leader’s performance

- Uses vague descriptions and skills.

- Doesn’t include years of teaching experience.

The fastest way to write your professional summary

Prove your value as a Leader with a sharply written professional summary. You can choose from expert-written content suggestions using our Resume Builder!

- 1

Enter the details about the job title you held. The builder comes preloaded with auto-suggested phrasing written by resume experts.

- 2

Then, just pick from these suggested phrases that best frame your experience and customize them to your liking!

- 3

All you have to do is choose the summary phrases that best frame your experience. It’s like having a professional do it for you!

Our Resume Builder is an ideal solution to all your resume-writing needs, but did you know that LiveCareer also offers professional resume-writing services? Take advantage of all the tools we have at your disposal and land your dream Leader job!

The reviews are in!

See what they're saying about us on Trustpilot.

Leader resume work experience examples

A big part of your resume’s content will live in your work experience, so you’ve got to put in the extra effort to make it stand out. This section should feature achievements that show recruiters you have what they’re looking for if you want to write a good resume.

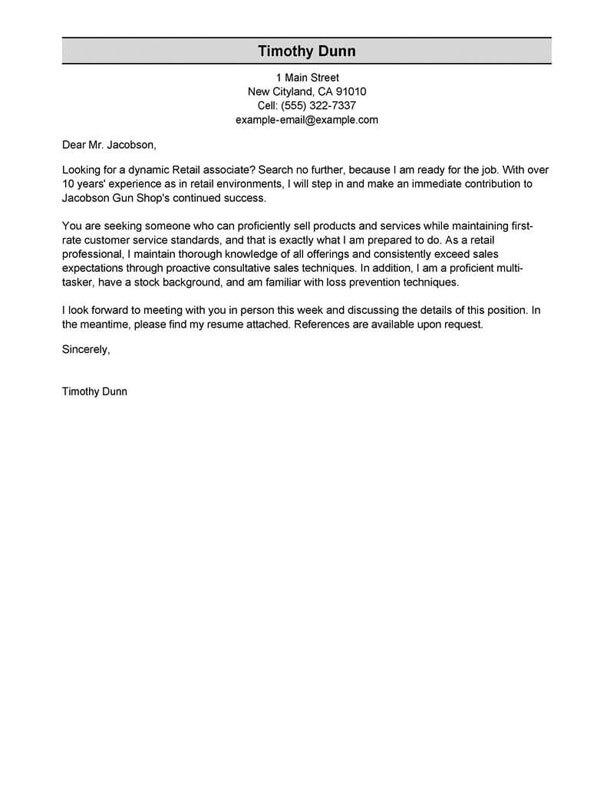

Good example:

Johnson Consulting I Rolling Meadows, IL I 8/2018-current

- Spearheaded a successful team-building initiative, resulting in a 20% increase in productivity

- Coordinated with other departments to ensure successful completion of projects within budget and timeline

- Developed and implemented strategies to streamline operations, resulting in a 15% reduction in costs

- Established an effective training program for new employees, increasing their productivity by 25%

Why this example passes:

- Numbers and statistics add detail and quantify the results this leader delivers: 4% improvement and a class size of 20-25.

- Good use of strong words and active language.

- References specialized value cahier provides with “individualized lesson plans.”

Bad example:

Malone Group I Redmond, WA I 4/2022-present

- Worked as a leader in a team environment

- Oversaw daily operations

- Assisted with customer service inquiries

- Monitored employee performance

Why this example fails:

- Lacks numbers or statistics.

- Describes general tasks, not teaching achievements or career highlights.

- Uses active verbs, but doesn’t focus on results.

Leader resume skills examples

Here are 11 sample skills for leader:

- Equipment Troubleshooting

- Team Building

- Process Improvement

- Line Management

- Quality Assurance Controls

- Expense Control

- Incidents management

- Recruitment and hiring

- Cash Flow analysis

- Continuous improvements

- Contract oversight

You should sprinkle skills and abilities throughout your resume. Include them in your professional summary, work experience blurbs and a dedicated skills section.

Examples of additional resume sections

Your Leader resume must include the following: contact information, resume summary, work experience, skills and education. These are the five main resume sections; however, you can customize your resume with additional sections.

Here are some examples of optional leader resume sections that you could add to provide greater detail:

- Languages

- Formation

- References

- Additional skills

- Profil professionnel

- Accomplishments

- Additional information

- Core qualifications

Including additional sections that help you convince employers you’re the best fit for the position. However, be selective about what qualifications you include, and eliminate any that don’t respond to the job’s specific requirements.

How to choose a resume format

0-3

Years of experience

Functional formats

- Focus on skills.

- Best for first-time leader who lack work experience.

- Good for people re-entering workforce.

- May omit dates in the work history section.

Organization:

- Skills listed above work experience.

3-10

Years of experience

Combination formats

- Balance skills and work history.

- Ideal for mid-career leader.

- Suitable for career changers and people seeking promotion.

Organization:

- Skills next to or above work experience.

10+

Years of experience

Chronological formats

- Put the most focus on work history.

- Best for leader with a long, steady career.

- Most popular format.

- Preferred by recruiters.

Organization:

- Work experience listed above skills.

Once you know the best format for you, it’s easy to pick a leader resume template. Templates are preformatted layouts created by design professionals to ensure your resume looks amazing!

Featured in:*

*The names and logos of the companies referred to in this page are all trademarks of their respective holders. Unless specifically stated otherwise, such references are not intended to imply any affiliation or association with LiveCareer.