Hard skills include skill in financial analysis, knowledge of debt recovery laws, and the ability to use collection software effectively.

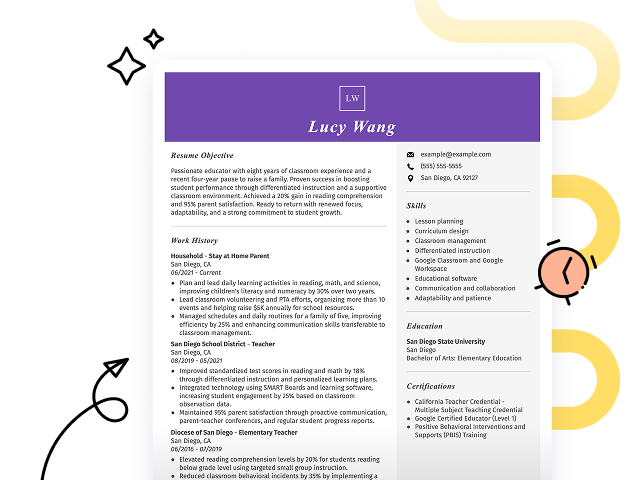

Popular Debt Collection Manager Resume Examples

Check out our top debt collection manager resume examples that emphasize key skills like negotiation, compliance, and team leadership. These examples show how you can effectively highlight your accomplishments to potential employers.

Ready to build your winning resume? Our Resume Builder offers user-friendly templates specifically designed for finance professionals, ensuring you make a lasting impression.

Recommended

Debt collection manager resume

The resume showcases a polished layout and modern resume fonts that improve readability, making it visually appealing. These design elements not only highlight the applicant's achievements but also convey professionalism, leaving a positive impression on potential employers.

Collections manager resume

This resume effectively combines essential skills like debt collection optimization and negotiation strategies with relevant work experience. By illustrating these abilities alongside practical accomplishments, employers can better understand the applicant's effectiveness in improving recovery rates and leading teams in challenging environments.

Recovery operations manager resume

This resume successfully uses bullet points to clearly outline the job seeker's extensive experience, making it easy for hiring managers to identify key achievements at a glance. The thoughtful spacing and organized sections ensure that important qualifications stand out without cluttering the page, improving overall readability.

Resume Template—Easy to Copy & Paste

Karen Gonzalez

Brookfield, WI 53005

(555)555-5555

Karen.Gonzalez@example.com

Professional Summary

Proven Debt Collection Manager with 9 years of success. Expert in recovery strategies and team leadership, driving compliance and performance with financial acumen.

Work History

Debt Collection Manager

FinSafe Solutions - Brookfield, WI

January 2023 - November 2025

- Reduced delinquency rates by 25%

- Improved recovery rate by 0K

- Led a team of 15 collectors

Account Recovery Lead

CreditGuard Partners - Waukesha, WI

May 2018 - December 2022

- Achieved 30% revenue growth

- Streamlined processes for efficiency

- Trained new hires, reducing turnover

Collections Supervisor

DebtShield Associates - Brookfield, WI

November 2016 - April 2018

- Elevated compliance standards by 15%

- Increased recovery outcomes by 20%

- Developed innovative negotiation strategies

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Intermediate (B1)

Skills

- Debt Recovery Strategies

- Team Leadership

- Performance Analysis

- Customer Negotiations

- Compliance Adherence

- Process Improvement

- Financial Reporting

- Conflict Resolution

Certifications

- Certified Collection Manager - American Collectors Association

- Advanced Negotiation Techniques - FinServe Training Institute

Education

Master of Business Administration Finance

NYU Stern School of Business New York, NY

May 2016

Bachelor of Science Business Administration

University of Iowa Iowa City, IA

May 2014

How to Write a Debt Collection Manager Resume Summary

Your resume summary is the first impression you'll make on potential employers, so it's important that it stands out. As a debt collection manager, you should highlight your leadership skills and expertise in financial recovery strategies that demonstrate your ability to drive results.

This profession requires showcasing your experience in managing teams and navigating complex negotiations. It's essential to emphasize your success in improving collection rates while maintaining positive client relationships.

To further guide you in crafting an effective summary, here are some examples that illustrate what works well and what doesn’t:

I am an experienced debt collection manager with many years in the field. I want to find a job that allows me to use my skills and offers a good working environment. I believe I can help improve the team’s performance if given the chance.

- Lacks concrete examples of achievements or skills specific to debt collection management

- Focuses more on personal desires rather than what value the job seeker brings to potential employers

- Uses vague language that does not effectively highlight relevant expertise or past successes

Results-driven debt collection manager with over 7 years of experience in high-volume collections and accounts receivable management. Successfully increased recovery rates by 25% through implementing targeted collection strategies and staff training programs. Proficient in using advanced debt recovery software, analyzing financial data, and maintaining compliance with regulatory requirements.

- Begins with specific years of experience and area of expertise

- Highlights a quantifiable achievement that illustrates effectiveness in improving recovery rates

- Mentions relevant technical skills that are important for success in a debt collection role

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a debt collection manager, where you'll showcase the bulk of your professional history. Good resume templates prioritize this section to help you stand out.

This part should be organized in reverse-chronological order, listing your previous positions clearly. Use bullet points to highlight key achievements and skills that demonstrate your effectiveness in managing collections.

To provide clarity on what works well, we’ll present examples of effective work experience entries for debt collection managers. These examples will outline best practices and common pitfalls:

Debt Collection Manager

Trent Collections Agency – Los Angeles, CA

- Managed collection activities

- Communicated with clients over the phone

- Prepared reports on collections status

- Trained new staff on procedures

- Lacks specific employment dates which are important for context

- Bullet points are overly generic and do not highlight achievements or skills

- Focuses too much on routine tasks instead of showcasing measurable results like improved collection rates

Debt Collection Manager

Credit Solutions Inc. – Newark, NJ

March 2020 - Current

- Lead a team of 15 collectors, achieving a 30% reduction in overdue accounts through streamlined processes and effective training

- Implemented data-driven strategies that increased recovery rates by 25% within the first year, improving overall financial performance

- Developed strong relationships with clients to facilitate negotiations, resulting in a 40% improvement in customer satisfaction scores

- Starts each bullet with dynamic action verbs that clearly convey achievements

- Uses specific metrics to highlight performance improvements and impact on the company

- Demonstrates key skills relevant to debt collection management such as leadership and negotiation

While your resume summary and work experience are important components, don’t overlook other sections that also deserve careful formatting. Each part of your resume plays a role in showcasing your qualifications. For more detailed guidance, visit our complete guide on how to write a resume.

Top Skills to Include on Your Resume

A well-defined skills section is important on your resume as it allows you to showcase your professional skills at a glance. It helps potential employers quickly identify the competencies that make you a suitable job seeker for the debt collection manager role.

Employers look for professionals who blend hands-on experience with strong communication and teamwork abilities. Showcasing both technical skills and interpersonal strengths on your resume demonstrates your capacity to deliver results and work effectively with others.

Soft skills encompass strong negotiation, empathy, and communication abilities that foster positive relationships with clients and ensure successful resolutions in debt management.

Selecting the right resume skills is important to meet employer expectations and navigate automated screening systems. These systems often filter out applicants lacking essential skills, so aligning your resume with desired qualifications can significantly influence your chances.

To identify which skills to emphasize, carefully review job postings for insights. Prioritize those that appeal to both recruiters and ATS systems, ensuring you stand out as a strong applicant in the selection process.

Pro Tip

10 skills that appear on successful debt collection manager resumes

Elevate your resume by highlighting key skills that are highly sought after for debt collection manager roles. You can find these essential skills demonstrated in our curated resume examples, which will help you present yourself confidently to potential employers.

By the way, here are 10 vital skills you should consider incorporating into your resume as they align with your experience and job requirements:

Negotiation

Conflict resolution

Attention to detail

Analytical thinking

Leadership

Time management

Customer service expertise

Regulatory knowledge

Data analysis skills

Team collaboration

Based on analysis of 5,000+ management professional resumes from 2023-2024

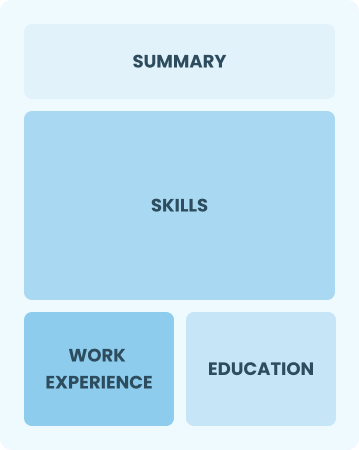

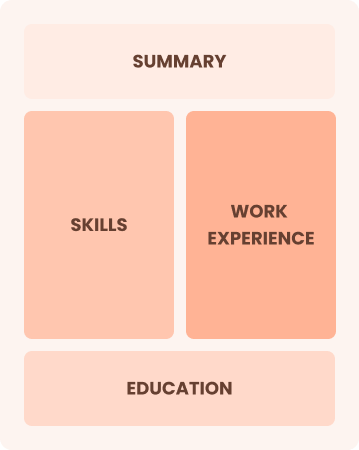

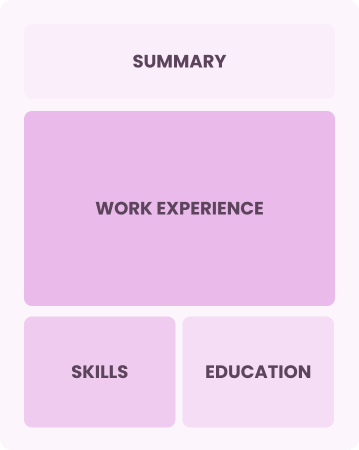

Resume Format Examples

Selecting the appropriate resume format is important for a debt collection manager, as it effectively showcases key achievements, relevant skills, and career growth in a clear and organized manner.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with up to two years of experience

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating their skills and potential for growth

Chronological

Emphasizes work history in reverse order

Best for:

Leaders in strategic debt recovery and team management

Frequently Asked Questions

Should I include a cover letter with my debt collection manager resume?

Absolutely, including a cover letter can significantly improve your application. It gives you the chance to showcase your personality and explain how your skills align with the position. If you’re looking for assistance, our guide on how to write a cover letter is a great resource. You can also use our Cover Letter Generator to create a tailored letter quickly.

Can I use a resume if I’m applying internationally, or do I need a CV?

As a debt collection manager, you might find that using a CV instead of a resume is beneficial when applying for international positions. A CV provides a comprehensive overview of your career and qualifications. Explore our resources on how to write a CV to ensure it aligns with global expectations. Additionally, reviewing various CV examples can help guide you in effectively presenting your experience and skills.

What soft skills are important for debt collection managers?

Soft skills like negotiation, empathy, and effective communication are essential for a debt collection manager. These interpersonal skills foster positive interactions with clients, encourage cooperation, and help resolve disputes amicably, ultimately leading to improved recovery rates and stronger client relationships.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as negotiation, communication, and analytical thinking when applying for debt collection manager roles. These abilities showcase your readiness to excel in a new environment, even with limited direct experience. Provide specific examples from previous jobs that illustrate how you've successfully resolved conflicts or improved processes related to collections.

How should I format a cover letter for a debt collection manager job?

To format a cover letter for debt collection manager positions, start with your contact details and a professional salutation. Then, create an engaging introduction that emphasizes your relevant experience. Include a concise summary of your qualifications that aligns with the job requirements. Conclude with a compelling call to action, motivating the employer to get in touch.

Should I use a cover letter template?

Using a cover letter template specifically designed for a debt collection manager improves the organization of your letter. This approach ensures you effectively highlight your negotiation skills and experience in managing collections processes, which are important to impress hiring managers.