Hard skills include technical abilities such as data analysis, project management, and strategic planning that are essential for driving organizational growth.

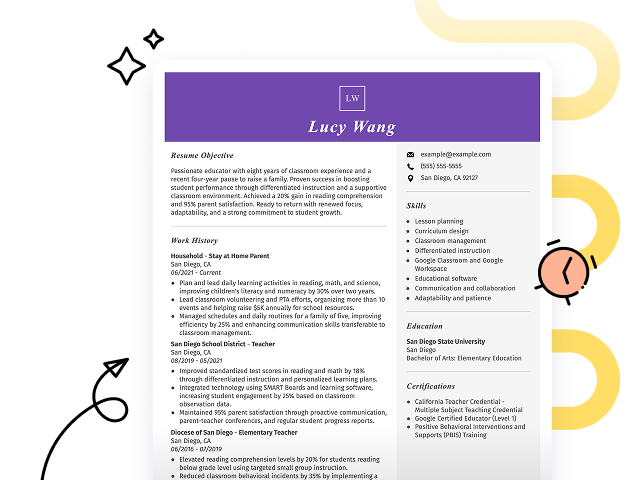

Popular Partner Resume Examples

Discover our top partner resume examples that emphasize key skills such as relationship management, negotiation tactics, and strategic planning. These examples illustrate how to effectively showcase your contributions and successes in the field.

Looking to build your own impressive resume? Our Resume Builder offers user-friendly templates designed specifically for partners to help you shine in your job applications.

Recommended

Entry-level partner resume

This entry-level resume effectively highlights the job seeker's leadership skills and significant achievements in business development, showcasing their ability to drive revenue growth and improve operational efficiency. New professionals in this field must demonstrate their strategic thinking and problem-solving abilities through quantifiable accomplishments, even if they have limited direct work experience.

Mid-career partner resume

This resume effectively illustrates the job seeker's qualifications by showcasing quantifiable achievements and leadership roles. The strategic presentation of responsibilities highlights their readiness for advanced challenges, demonstrating a strong career trajectory in consultancy and business development.

Experienced partner resume

This work experience section demonstrates the applicant's substantial impact as a partner, highlighted by leading 15% annual revenue growth and implementing AI solutions that reduced costs by 20%. The clear formatting allows hiring managers to quickly assess these impressive achievements.

Resume Template—Easy to Copy & Paste

Daniel Wang

Westbrook, ME 04097

(555)555-5555

Daniel.Wang@example.com

Skills

- Strategic Planning

- Leadership Development

- Business Development

- Financial Modeling

- Market Research

- Client Relationship Management

- Process Optimization

- Revenue Growth Strategy

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Professional Summary

Results-driven Partner with 7 years of leadership in strategy, client acquisition, and team management. Proven success in driving market growth and delivering scalable solutions. Adept at maximizing revenue and streamlining process efficiencies within competitive industries.

Work History

Partner

Paramount Consulting Group - Westbrook, ME

May 2022 - December 2025

- Led client acquisition, grew revenue by 25% annually.

- Developed strategic partnerships, increasing market presence by 40%.

- Guided a high-performing team of 15 consultants to success.

Senior Business Consultant

Summit Strategy Advisors - Portland, ME

May 2018 - April 2022

- Directed process optimization, reducing costs by 18%.

- Spearheaded project implementations within set deadlines, boosting client satisfaction.

- Generated M in revenue by identifying market opportunities.

Strategy Analyst

Pinnacle Advisory Solutions - Portland, ME

December 2015 - April 2018

- Conducted in-depth market analysis, increasing ROI by 30%.

- Collaborated on strategy execution, delivering 100% client targets.

- Prepared financial reports, ensuring accuracy for M portfolio.

Certifications

- Certified Management Consultant (CMC) - Institute of Management Consultants USA

- Advanced Leadership Certification - Harvard Business Publishing

Education

Master of Business Administration Business Strategy

Harvard Business School Cambridge, MA

May 2015

Bachelor of Science Economics

Stanford University Stanford, CA

May 2013

How to Write a Partner Resume Summary

Your resume summary is the first thing employers will notice, making it important to create a strong impression that highlights your qualifications. As a partner, you should emphasize your collaboration skills and ability to drive results within teams.

In this section, focus on showcasing your leadership qualities, strategic thinking, and industry-specific achievements. These elements will set you apart from other job seekers and illustrate your value.

To illustrate effective strategies for crafting your resume summary, we’ll review some examples that demonstrate what works well in this critical section:

I am a dedicated partner with many years of experience in various roles. I seek an opportunity that allows me to use my skills effectively and contribute positively to the team. A supportive environment with chances for personal development is what I’m looking for. I believe I can add value if given the chance.

- Contains broad claims about experience without mentioning specific skills or achievements

- Focuses primarily on personal desires rather than showcasing how the applicant can benefit the employer

- Relies on generic language rather than providing concrete examples that highlight qualifications

Results-driven partner with over 7 years of experience in strategic business development and client relationship management. Successfully increased client retention rates by 20% through the implementation of personalized service solutions and feedback systems. Proficient in CRM software, data analysis, and team leadership to drive operational excellence.

- Highlights extensive experience level relevant to partnership roles

- Demonstrates measurable impact through quantifiable achievement that improves client relationships

- Showcases essential skills relevant to the industry, such as CRM skill and team leadership

Pro Tip

Showcasing Your Work Experience

As a partner, your resume's work experience section is important. It's the area where you'll provide most of your content, and any strong resume template will incorporate this key segment.

Your work history should be displayed in reverse-chronological order, accompanied by bullet points highlighting your accomplishments and responsibilities in each role you've held as a partner.

Now let's look at several examples to demonstrate effective entries for partners. These examples will illustrate what captures attention and what falls short:

Partner

ABC Consulting Group – New York, NY

- Advised clients on business strategies.

- Attended meetings and contributed ideas.

- Managed project timelines and deliverables.

- Worked with team members to achieve goals.

- Lacks specific accomplishments or results that showcase impact

- Vague bullet points do not highlight unique skills or strengths

- Does not mention collaboration outcomes or leadership roles

Partnership Manager

Global Solutions Inc. – San Francisco, CA

March 2020 - Present

- Develop strategic partnerships that increased revenue by 40% through collaborative projects with key industry leaders.

- Lead cross-functional teams to drive partnership initiatives, achieving a 30% faster project completion rate over the past year.

- Conduct regular performance reviews of partner agreements, ensuring compliance and optimizing outcomes for all stakeholders.

- Uses powerful action verbs at the start of each bullet point to highlight contributions effectively

- Incorporates specific metrics to illustrate the impact of the job seeker’s efforts on business growth

- Emphasizes relevant skills like leadership and compliance management essential for the role

While your resume summary and work experience are important, don’t overlook the other important sections that contribute to a compelling presentation. To ensure every part of your resume shines, check out our detailed guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is an essential component of any compelling resume. It provides a snapshot of your qualifications, making it easier for employers to see if you are the right fit for the role.

Add both hard and soft skills to create a well-rounded resume.

Soft skills encompass interpersonal qualities like collaboration, adaptability, and communication, which are important for building strong partnerships and fostering a positive work environment.

When selecting resume skills for your resume, it is important to align with what employers expect and consider how automated screening systems work. Many organizations use software that filters out job seekers lacking the essential skills required for the position.

To improve your chances of standing out, carefully review job postings for insights on which skills to highlight. This approach helps you tailor your resume effectively for both recruiters and ATS systems alike.

Pro Tip

10 skills that appear on successful partner resumes

Highlighting key skills on your resume can significantly increase your appeal to recruiters looking for partners. These high-demand skills are essential in the field, and you can see them showcased effectively in our resume examples, helping you present yourself confidently to potential employers.

By the way, make sure to include any relevant skills from the following list that align with your experience and job requirements:

Collaboration

Conflict resolution

Negotiation

Interpersonal communication

Project management

Strategic planning

Cultural awareness

Adaptability

Time management

Networking

Based on analysis of 5,000+ law professional resumes from 2023-2024

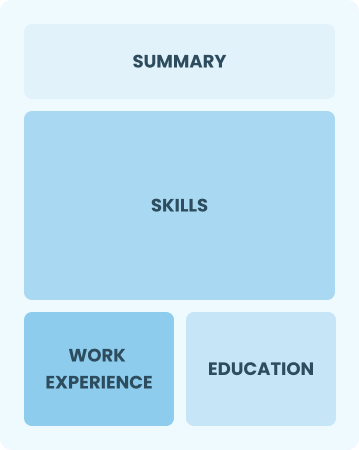

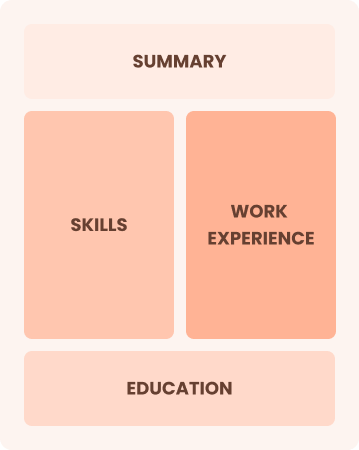

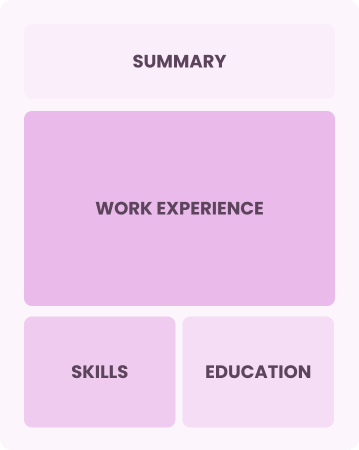

Resume Format Examples

Selecting the ideal resume format is important for partners to showcase their leadership abilities, strategic thinking, and professional achievements effectively.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with up to two years of experience

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating their skills and potential for growth

Chronological

Emphasizes work history in reverse order

Best for:

Leaders in healthcare with specialized expertise and extensive experience

Frequently Asked Questions

Should I include a cover letter with my partner resume?

Absolutely. Including a cover letter can significantly improve your job application by showcasing your personality and demonstrating your enthusiasm for the position. It offers you a chance to highlight key experiences relevant to the role. For assistance, explore our comprehensive guide on how to write a cover letter or use our Cover Letter Generator for quick results.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, use a CV instead of a resume as it is often the preferred format. To assist you, we provide resources such as CV examples that will guide you in crafting a CV that aligns with international expectations. Additionally, our tips on how to write a CV can be invaluable in ensuring your document meets global standards.

What soft skills are important for partners?

Soft skills such as communication, empathy, and interpersonal skills like conflict resolution are essential for partners. They foster trust and understanding, enabling effective collaboration and stronger relationships both personally and professionally.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as communication, teamwork, and adaptability from previous roles. These competencies can greatly improve your candidacy for partner positions, even if you lack direct industry experience. Use concrete examples to illustrate how your past achievements relate to key responsibilities in the role, showcasing your potential value to the organization.

Should I include a personal mission statement on my partner resume?

Including a personal mission statement on your resume is recommended. It showcases your values and career aspirations effectively, which can be particularly beneficial when applying to organizations that prioritize cultural fit or have a strong mission-driven focus.

How do I add my resume to LinkedIn?

To increase your resume's visibility on LinkedIn, you can add your resume to LinkedIn directly or highlight key experiences in the "About" and "Experience" sections. This approach allows recruiters to quickly identify your qualifications, making it easier for them to connect with suitable job seekers like you.