Hard skills include expertise in client relationship management, data analysis, and strategic planning, which are essential for driving business success.

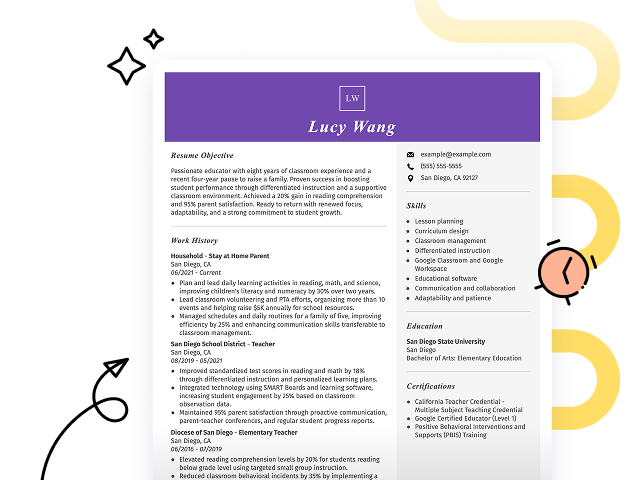

Popular Account Manager Resume Examples

Check out our top account manager resume examples that emphasize important skills like client relations, strategic planning, and sales growth. These examples provide a clear blueprint for showcasing your professional accomplishments.

Are you ready to build an impressive resume? Our Resume Builder offers user-friendly templates specifically designed for account management professionals, making it simple to highlight your strengths.

Recommended

Entry-level account manager resume

This entry-level resume for an account manager effectively highlights the job seeker's ability to drive client growth and retention, showcasing significant achievements such as a 20% increase in client accounts. New professionals in this field must convey their strategic thinking and relationship-building capabilities through quantifiable successes, even with limited experience.

Mid-career account manager resume

This resume effectively showcases qualifications by detailing significant achievements and skills relevant to account management. The clear progression through roles illustrates the applicant's readiness for increased responsibilities and leadership opportunities, highlighting a commitment to client success and revenue growth.

Experienced account manager resume

The work history section effectively showcases the applicant's achievements as an account manager, notably increasing revenue by 25% and implementing a CRM system that improved efficiency by 20%. The bullet points improve readability, making it easy for hiring managers to quickly assess key accomplishments.

Resume Template—Easy to Copy & Paste

David Nguyen

Pinehill, TX 75757

(555)555-5555

David.Nguyen@example.com

Professional Summary

Accomplished Account Manager with expertise in client relationship management, strategic sales planning, and negotiation. Proven track record of increasing client bases and improving revenue through innovative strategies. Fluent in Spanish and well-versed in CRM software.

Work History

Account Manager

EdgeTech Solutions - Pinehill, TX

June 2023 - November 2025

- Increased client base by 25% in one year.

- Managed accounts worth over million.

- Improved customer retention by 30%.

Client Relations Specialist

Skyward Strategies - Austin, TX

February 2020 - May 2023

- Enhanced client satisfaction by 20%.

- Developed strategies to boost sales by 15%.

- Coordinated projects improving efficiency by 10%.

Sales Account Executive

Innovate Marketing Group - Pinehill, TX

November 2018 - January 2020

- Exceeded sales targets by 35% annually.

- Onboarded over 50 new clients.

- Expanded market reach by 18%.

Skills

- Client Relationship Management

- Strategic Sales Planning

- Negotiation Skills

- CRM Software Proficiency

- Market Analysis

- Project Coordination

- Communication Skills

- Problem Solving

Education

Master of Business Administration Business Management

University of North Carolina Chapel Hill, North Carolina

May 2018

Bachelor of Arts Marketing

North Carolina State University Raleigh, North Carolina

May 2016

Certifications

- Certified Account Manager - National Association of Account Managers

- CRM Software Expert - TechPro Training Institute

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

How to Write an Account Manager Resume Summary

Your resume summary is the first impression you’ll make on hiring managers, so it’s important to highlight your strengths effectively. As an account manager, you should focus on showcasing your relationship-building skills and ability to drive revenue growth.

This profession requires a mix of strategic thinking and exceptional communication abilities. You want to emphasize your experience in managing client accounts and delivering successful outcomes that exceed expectations.

To help clarify what works in an effective resume summary, we’ll look at examples tailored for account managers. These will provide insights into crafting a compelling introduction:

I am an experienced account manager seeking a role where I can use my skills to help the company grow. I desire a position that offers career advancement and a supportive work environment. With my extensive background, I believe I can contribute positively if given the opportunity.

- Lacks specific examples of achievements or skills relevant to account management

- Focuses more on personal desires rather than what the applicant can provide to the employer

- Uses vague language that doesn't clearly define unique qualifications or strengths

Results-oriented account manager with over 6 years of experience in driving revenue growth and managing client relationships in the technology sector. Achieved a 25% increase in quarterly sales through strategic upselling and exceptional customer service, while maintaining a 95% client retention rate. Proficient in CRM software, data analysis, and cross-functional collaboration to improve client satisfaction.

- Starts with specific experience level and industry focus

- Highlights quantifiable achievements that demonstrate significant impact on sales performance

- Mentions relevant technical skills that are important for success in account management roles

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as an account manager, representing the bulk of your content. Resume templates always emphasize this significant section to showcase your professional journey effectively.

This part of your resume should be organized in reverse-chronological order, clearly listing your previous positions. Use bullet points to highlight key achievements and contributions you made in each role.

Now, let’s examine a few examples that illustrate effective work history entries for account managers. These examples will help clarify what makes a strong entry and what pitfalls to avoid:

Account Manager

ABC Marketing Solutions – New York, NY

- Managed client accounts.

- Communicated with clients regularly.

- Created reports for management.

- Assisted in project coordination.

- Lacks specific achievements or metrics that demonstrate success

- Descriptions are too broad and do not highlight unique skills

- Fails to provide context on the impact of responsibilities on the company

Account Manager

Tech Solutions Inc. – San Francisco, CA

March 2020 - Present

- Develop and maintain strategic relationships with key clients, leading to a 30% increase in client retention rates.

- Collaborate with cross-functional teams to deliver tailored solutions, resulting in a 15% boost in sales within the first year.

- Conduct regular performance reviews with clients, using feedback to improve service delivery and achieve an average satisfaction rating of 4.8/5.

- Starts each bullet with compelling action verbs that clearly describe achievements

- Incorporates quantifiable results like percentages to highlight success

- Showcases essential skills relevant to the role, improving overall effectiveness of the entry

While your resume summary and work experience are undoubtedly important, don’t overlook the importance of other sections. Each part plays an important role in showcasing your qualifications. For more detailed advice on crafting a standout resume, explore our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is an important part of any compelling resume. It allows you to showcase your qualifications and makes it easy for employers to identify if you are the right fit for the role.

As an account manager, emphasize both hard and soft skills. Highlight experience with CRM software like Salesforce, data analysis tools such as Excel, and project management systems that improve client relationships and support strategic initiatives.

Soft skills encompass effective communication, problem-solving, and adaptability, fostering strong client connections and improving teamwork to meet customer needs efficiently.

When selecting skills for your resume, it’s important to align with what employers expect. Many organizations use applicant tracking systems (ATS) that filter out job seekers lacking essential resume skills.

To improve your chances of being noticed, carefully examine job postings. They often highlight the specific skills recruiters value, guiding you on which abilities to showcase prominently in your application.

Pro Tip

10 skills that appear on successful account manager resumes

Elevate your resume by highlighting the most sought-after skills for account managers. These in-demand abilities can help you capture recruiters' attention and are featured in our resume examples.

By the way, here are 10 essential skills you should consider including in your resume if they align with your qualifications and job expectations:

Client relationship management

Negotiation expertise

Strategic thinking

Effective communication

Problem-solving abilities

Time management

Sales skill

Analytical skills

Project management

Team collaboration

Based on analysis of 5,000+ management professional resumes from 2023-2024

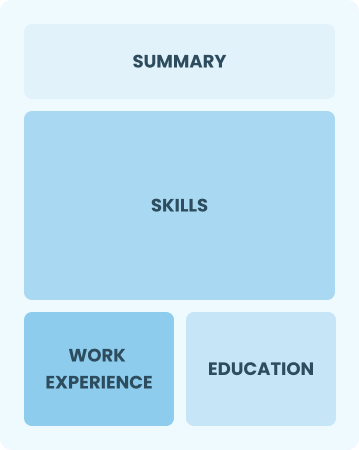

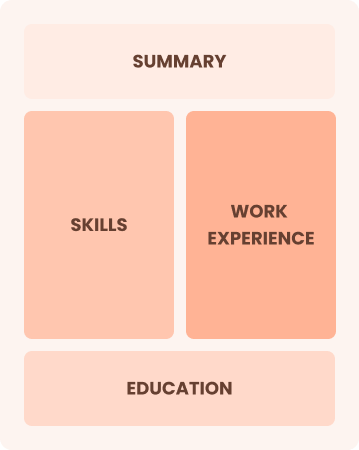

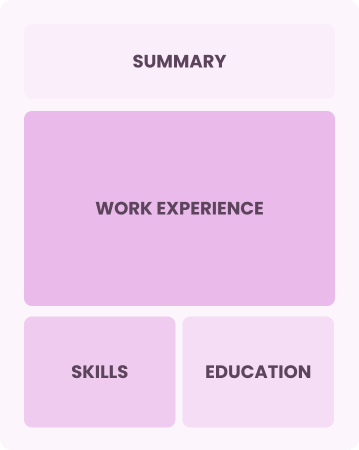

Resume Format Examples

Choosing the optimal resume format is important for account managers because it highlights your key achievements, relevant skills, and professional growth in a clear and effective manner.

Functional

Focuses on skills rather than previous jobs

Best for:

Best for recent graduates and career changers with limited experience

Combination

Balances skills and work history equally

Best for:

Account managers eager to highlight their skills and pursue new opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Senior registered nurses in leadership or specialized clinical roles

Frequently Asked Questions

Should I include a cover letter with my account manager resume?

Absolutely, including a cover letter is a great way to showcase your personality and highlight your qualifications. It allows you to connect the dots between your experience and the job you're applying for. If you need assistance with crafting one, our guide on how to write a cover letter or the Cover Letter Generator can help you create a professional document in just a few minutes.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs outside the U.S., use a CV instead of a resume, as many countries prefer this format. To assist you, we offer resources on how to write a CV that detail proper CV formatting and creation, ensuring your application meets international expectations. Additionally, explore our CV examples to see how effectively formatted applications look in practice.

What soft skills are important for account managers?

Soft skills such as communication, negotiation, and problem-solving are essential for account managers. These interpersonal skills foster strong client relationships and facilitate effective collaboration within teams, ultimately driving customer satisfaction and business success.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as communication, project management, and teamwork from previous roles. These qualities illustrate your ability to impact account management positively despite limited direct experience. Share concrete examples of how you have successfully managed projects or maintained client relationships in the past to showcase your relevant capabilities.

How do I write a resume with no experience?

If you're pursuing an account manager role with limited experience, you can learn how to effectively highlight transferable skills like communication, problem-solving, and teamwork in a resume with no experience. Showcase any internships, projects, or relevant coursework that demonstrate your ability to build relationships and manage client expectations. Your enthusiasm and willingness to learn can impress employers and set you apart from other applicants.

How do I add my resume to LinkedIn?

You can add your resume to LinkedIn by uploading it to your profile or including essential details in the "About" and "Experience" sections. This approach helps recruiters easily find skilled account managers like you, making a strong impression in the competitive job market.