Hard skills include expertise in office software, scheduling, and data management, which are essential for maintaining efficient administrative operations.

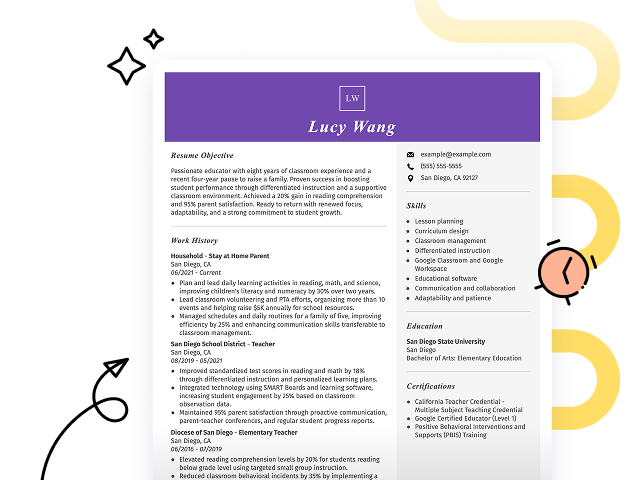

Popular Administrative Assistant Resume Examples

Check out our top administrative assistant resume examples that emphasize key skills such as organization, communication, and multitasking. These examples will help you highlight your strengths and make a great impression on potential employers.

Want to put your best foot forward? Our Resume Builder offers user-friendly templates designed specifically for administrative professionals, making it simple to create an eye-catching resume.

Recommended

Entry-level administrative assistant resume

This entry-level resume for an administrative assistant effectively showcases the applicant's organizational and problem-solving skills through quantified achievements in previous roles, such as improving office efficiency by 15% and managing substantial budgets. New professionals must highlight relevant competencies and any strong contributions during internships or academic projects to attract potential employers, even with limited work history.

Mid-career administrative assistant resume

This resume effectively outlines a strong track record of improving office efficiency and managing complex tasks. The clear presentation of achievements and skills demonstrates readiness for higher responsibilities, reflecting the applicant's growth and capability to handle leadership roles in administration.

Experienced administrative assistant resume

This resume's work history section demonstrates the applicant's extensive experience as an administrative assistant, highlighting significant achievements like reducing costs by 15% and improving data entry efficiency by 30%. The clear formatting allows hiring managers to quickly grasp the applicant's impact and skills.

Resume Template—Easy to Copy & Paste

Aya Rodriguez

Spokane, WA 99209

(555)555-5555

Aya.Rodriguez@example.com

Professional Summary

Dynamic Administrative Assistant skilled in office management, reducing costs by 15%, and optimizing schedules by 30%. Proven track record in streamlining operations to enhance efficiency and client satisfaction.

Work History

Administrative Assistant

NorthStar Operations - Spokane, WA

December 2023 - September 2025

- Managed office supplies reducing costs by 15%

- Coordinated 10+ client meetings monthly

- Streamlined filing system saving 20 hours/month

Executive Administrative Coordinator

Crescent Management Group - Eastside, WA

June 2021 - November 2023

- Improved scheduling accuracy by 30%

- Oversaw budget reports for 5 departments

- Organized annual corporate events for 200 attendees

Office Operations Associate

Tech Solutions International - Eastside, WA

January 2020 - May 2021

- Maintained office systems improving workflow by 25%

- Trained 5 new hires quarterly

- Assisted in reducing process lead times by 10%

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Skills

- Office Management

- Event Coordination

- Budget Management

- Client Communication

- Schedule Optimization

- Process Improvement

- Document Management

- Team Collaboration

Certifications

- Certified Administrative Professional - International Association of Administrative Professionals

- Office Administration Specialist - Institute of Professional Administrators

Education

Master of Business Administration Business Administration

University of Washington Seattle, Washington

June 2019

Bachelor of Arts Communication

Oregon State University Corvallis, Oregon

June 2017

How to Write an Administrative Assistant Resume Summary

Your resume summary is the first thing employers will read, making it a vital opportunity to create a lasting impression. As an administrative assistant, you should highlight your organizational skills, attention to detail, and ability to manage multiple tasks efficiently.

This profession requires showcasing your skill in office software, communication abilities, and problem-solving skills. These attributes are essential for ensuring smooth operations in any workplace.

To help you craft an effective resume summary, consider the following examples that illustrate what works well and what may fall short:

I am an experienced administrative assistant who has worked for several years in various office settings. I want a job where I can use my skills and help the company succeed. A supportive environment with room to grow is what I'm looking for. I believe I can be a great addition to your team if given the chance.

- Lacks specific details about the applicant's skills and previous accomplishments, making it hard to assess their qualifications

- Focuses on personal desires rather than emphasizing how they can add value to the employer

- Uses generic phrases like 'experienced' without demonstrating any unique strengths or contributions

Organized administrative assistant with over 6 years of experience in fast-paced office environments, proficient in managing schedules and improving workflow efficiency. Implemented a new filing system that improved document retrieval time by 30%, contributing to an increase in overall team productivity. Skilled in Microsoft Office Suite, customer service, and data entry, ensuring smooth operational support for executives.

- Begins with a clear statement of experience level and relevant expertise

- Highlights a specific achievement that quantifies improvement in productivity

- Mentions essential technical skills that are vital for administrative roles

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as an administrative assistant, serving as the main focus and containing the bulk of your content. Good resume templates always feature this section prominently to highlight your professional background.

To present this section effectively, organize it in reverse-chronological order, listing your previous positions clearly. Use bullet points to detail your achievements and contributions in each role, making it easy for hiring managers to recognize your strengths.

Now, let's look at a couple of examples that demonstrate effective entries for administrative assistants. These examples will reveal what works well and what might fall short:

Administrative Assistant

Office Solutions Inc. – Atlanta, GA

- Answered phones and greeted visitors

- Managed schedules and organized files

- Performed basic data entry tasks

- Assisted with general office duties

- Lacks employment dates which are important for context

- Bullet points are overly simplistic and do not highlight specific skills or achievements

- Focuses on routine tasks rather than showcasing any measurable impact or contributions

Administrative Assistant

Tech Solutions Inc. – San Francisco, CA

March 2020 - Current

- Manage scheduling and correspondence for a team of 10, improving communication flow by 30%

- Develop and maintain organized filing systems that increased document retrieval efficiency by 40%

- Assist in preparing reports and presentations, contributing to a streamlined process that reduced project completion times by 20%

- Starts each bullet with compelling action verbs highlighting the job seeker's contributions

- Incorporates specific metrics to illustrate the impact of their efforts

- Showcases essential skills relevant to the administrative field throughout the accomplishments

While the resume summary and work experience sections often take center stage, it's essential to pay attention to all areas of your resume. Each section contributes to a complete picture of your qualifications. For more detailed insights, be sure to check out our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for any resume as it provides a quick snapshot of your qualifications. It allows employers to see, at a glance, if you possess the essential capabilities needed for the role.

To succeed as an administrative assistant, you've got to balance hard and soft skills. Hard skills prove you possess the necessary knowledge to thrive on the role, and soft skills allow you to be a more efficient worker and team member.

Soft skills encompass strong communication, organization, and problem-solving abilities that foster a collaborative work environment and improve overall productivity.

When selecting skills for your resume, it's important to align them with what employers expect from applicants. Many organizations use automated screening systems that filter out applicants lacking essential resume skills.

To effectively highlight your strengths, review job postings closely for the specific skills mentioned. This approach ensures that you prioritize relevant abilities, making it easier for both recruiters and ATS systems to recognize you as a strong job seeker.

Pro Tip

10 skills that appear on successful administrative assistant resumes

Make your resume stand out to recruiters by showcasing essential skills that administrative assistants need. You can find these skills highlighted in our resume examples, which will help you apply with confidence and professionalism.

Here are 10 skills you should consider including in your resume if they align with your experience and job demands:

Data entry

Computer skills

Customer service

Problem-solving

Microsoft excel

Customer and client relations

Documentation and recordkeeping

Microsoft word

Critical thinking

Office administration

Based on analysis of 5,000+ administrative professional resumes from 2023-2024

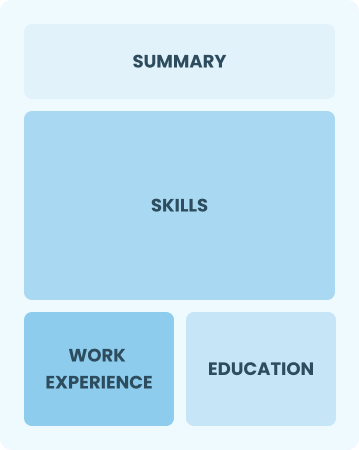

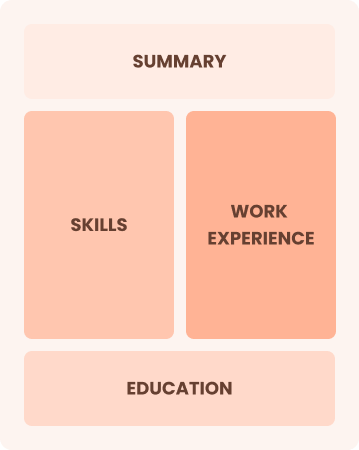

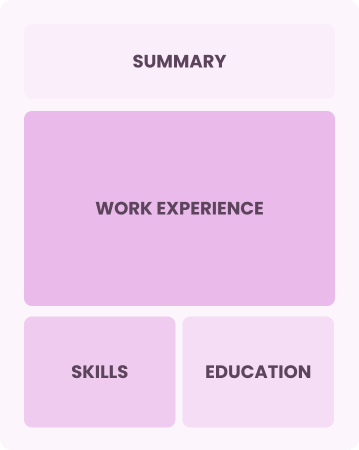

Resume Format Examples

Choosing the resume format that best suits an administrative assistant is important, as it showcases key skills, relevant experience, and career growth in a clear and organized manner.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with limited experience seeking entry-level roles

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating skills and pursuing new opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Experienced leaders excelling in complex administrative environments

Administrative Assistant Salaries in the Highest-Paid States

Our administrative assistant salary data is based on figures from the U.S. Bureau of Labor Statistics (BLS), the authoritative source for employment trends and wage information nationwide.

Whether you're entering the workforce or considering a move to a new city or state, this data can help you gauge what fair compensation looks like for administrative assistants in your desired area.

Frequently Asked Questions

Should I include a cover letter with my administrative assistant resume?

Absolutely, including a cover letter can significantly improve your application. It allows you to elaborate on your skills and show your enthusiasm for the position. For assistance, consider our step-by-step guide on how to write a cover letter or use our easy Cover Letter Generator to craft one quickly.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, use a CV instead of a resume to provide a comprehensive overview of your qualifications and experiences. To ensure your document aligns with international expectations, explore CV examples that showcase effective layouts and formats. Additionally, learn how to write a CV tailored to specific industries and roles so your application stands out to potential employers.

What soft skills are important for administrative assistants?

Soft skills like organization, communication, and interpersonal skills are essential for administrative assistants. These abilities enable efficient office management and foster positive interactions with colleagues and clients, ensuring smooth operations and professional relationships.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as organization, communication, and attention to detail from previous roles. These abilities are important in administrative assistant positions, showcasing your potential to excel despite a lack of direct experience. Provide concrete examples from prior jobs that illustrate how these strengths will improve office efficiency and support team productivity.

Where can I find inspiration for writing my cover letter as a administrative assistant?

Consider exploring cover letter examples tailored for administrative assistant positions. These samples offer valuable content ideas, formatting tips, and effective ways to showcase your qualifications. Using them as inspiration can make a significant difference in presenting your application confidently.

Should I use a cover letter template?

Using a cover letter template for administrative assistant roles can improve the structure of your letter, helping you organize content efficiently. It allows you to showcase essential skills like skill in office software and strong communication abilities that resonate with hiring managers.