Hard skills include expertise in academic advising, knowledge of college admissions processes, and skill in career counseling techniques.

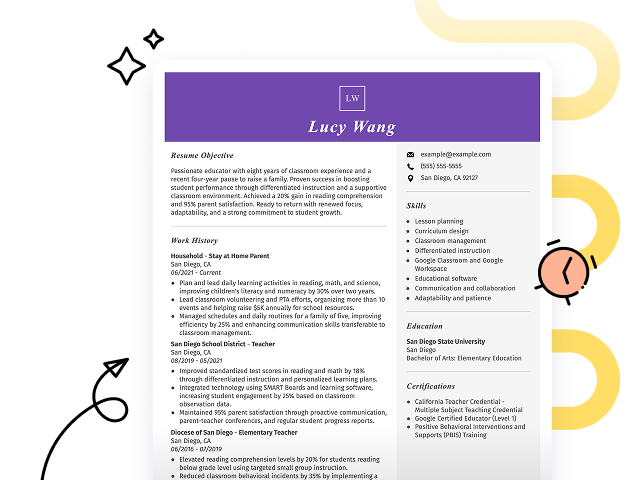

Popular College Counselor Resume Examples

Check out our top college counselor resume examples that showcase critical skills such as student engagement, academic advising, and career planning. These examples will help you effectively communicate your accomplishments to prospective employers.

Ready to build your ideal resume? Our Resume Builder offers user-friendly templates specifically designed for educational professionals, making it simple to create a standout application.

Recommended

Entry-level college counselor resume

This entry-level resume for a college counselor highlights the job seeker's ability to effectively guide students in their college selection process, evidenced by a notable increase in student acceptance rates. New professionals in this field must showcase their counseling skills and achievements while demonstrating a proactive approach to student development, even with limited direct experience.

Mid-career college counselor resume

This resume effectively showcases qualifications by highlighting strong achievements, such as increasing application submissions and improving student retention. This positions the job seeker as a driven professional ready to tackle advanced challenges and leadership roles in college counseling.

Experienced college counselor resume

This work history section effectively demonstrates the applicant's effective contributions as a college counselor, highlighting achievements such as a 25% increase in student success rates and guiding over 300 students in career planning. The clear formatting allows hiring managers to quickly identify key accomplishments.

Resume Template—Easy to Copy & Paste

Ming Davis

Seattle, WA 98106

(555)555-5555

Ming.Davis@example.com

Professional Summary

Experienced college counselor skilled in educational counseling, student development, and program leadership. Proven track record of improving student satisfaction and retention rates through innovative initiatives.

Work History

College Counselor

Springfield Student Advisory - Seattle, WA

December 2023 - December 2025

- Guided 100+ students to career paths

- Increased student satisfaction by 30%

- Developed 5 innovative counseling programs

Academic Advisor

Pioneer Education Group - Eastside, WA

December 2021 - November 2023

- Improved student retention by 25%

- Facilitated workshops for 200 students

- Designed a new advisor training manual

Student Services Coordinator

Lincoln College Campus Services - Seattle, WA

December 2020 - November 2021

- Managed student inquiries with 95% satisfaction

- Organized events with 500+ attendees

- Streamlined processes reducing time by 20%

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Skills

- Career Counseling

- Student Development

- Program Leadership

- Academic Advising

- Workshop Facilitation

- Communication Skills

- Conflict Resolution

- Data Analysis

Certifications

- Certified Educational Professional - National Board for Professional Teaching Standards

- Career Development Facilitator - National Career Development Association

Education

Master of Education Educational Counseling

University of Illinois Urbana-Champaign, Illinois

May 2019

Bachelor of Science Psychology

Illinois State University Normal, Illinois

May 2017

How to Write a College Counselor Resume Summary

Your resume summary is the first opportunity to capture an employer's attention, making it important to present yourself effectively. As a college counselor, you should highlight your skills in student guidance, academic planning, and communication to set yourself apart.

This profession demands that you emphasize your ability to foster relationships with students and provide tailored advice based on their unique needs. Showcasing your experience in helping students navigate their educational paths will resonate strongly with hiring managers.

To help illustrate what makes an effective resume summary, here are some examples that demonstrate best practices and common pitfalls:

I am a dedicated college counselor with several years of experience. I hope to find a position where I can use my skills to help students succeed. A supportive environment that values education and personal development is what I’m looking for. I believe I can contribute positively if given the chance.

- Contains vague phrases that do not highlight specific achievements or expertise in counseling

- Overuses personal pronouns, making it feel less professional and more self-focused

- Emphasizes the job seeker's desires over the value they bring to potential employers, missing key contributions they could offer

Dynamic college counselor with 8+ years of experience in higher education advising, focusing on student engagement and career development. Successfully increased student retention rates by 20% through personalized academic planning and proactive outreach initiatives. Proficient in using counseling software, conducting workshops, and collaborating with faculty to create supportive environments for diverse student populations.

- Begins with clear experience level and area of expertise within college counseling

- Highlights a specific achievement that quantifies the impact on student retention

- Emphasizes relevant skills and collaborative efforts that are essential in a counseling role

Pro Tip

Showcasing Your Work Experience

The work experience section is the centerpiece of your resume as a college counselor, where you'll provide the bulk of your content. Good resume templates always emphasize this important section.

This part should be organized in reverse-chronological order, listing your previous positions. Use bullet points to highlight key achievements and responsibilities in each role you've held.

To illustrate effective entries for college counselors, we’ll present a couple of examples that clearly demonstrate what works well and what doesn’t:

College Counselor

Sunnydale High School – Sunnydale, CA

- Advised students on college applications.

- Helped with personal statements and resumes.

- Conducted workshops about college readiness.

- Provided general support to students.

- Lacks specific accomplishments or outcomes from counseling sessions

- Bullet points are vague and do not highlight unique skills or successes

- Does not include any measurable results or impact on students' college admissions

College Counselor

Sunset High School – Los Angeles, CA

August 2020 - Current

- Guide students through the college application process, resulting in a 30% increase in successful admissions to four-year universities.

- Develop and implement workshops on financial aid and scholarship opportunities, improving student awareness and participation by 40%.

- Provide one-on-one counseling sessions to over 100 students annually, facilitating personalized educational plans that align with their career goals.

- Starts each bullet with compelling action verbs that clearly communicate achievements

- Incorporates quantifiable results to illustrate the effectiveness of initiatives and support

- Highlights essential counseling skills while demonstrating positive outcomes for students

While your resume summary and work experience are key components, don't overlook other sections that need proper formatting. For more guidance on creating a standout resume, explore our complete guide on how to write a resume.

Top Skills to Include on Your Resume

A well-defined skills section is important for any resume, as it allows you to showcase your qualifications in a clear and concise manner. This section helps potential employers quickly assess whether you possess the necessary abilities for the college counselor role.

For a college counselor, it's important to highlight both hard and soft skills that encompass interpersonal and technical skills. Focus on areas like student assessment tools, software such as Naviance or PowerSchool, and communication platforms that improve engagement with students and parents.

Soft skills encompass strong communication, active listening, and empathy, which are essential for building rapport with students and supporting their personal and academic growth.

Selecting the right resume skills is important for aligning with what employers expect from applicants. With many companies using automated screening systems, it’s essential to include relevant skills that can get you noticed.

To effectively prioritize skills, carefully review job postings for insights into what recruiters are seeking. This practice helps ensure that your resume resonates with both hiring managers and ATS software, boosting your chances of making it through the initial screening process.

Pro Tip

10 skills that appear on successful college counselor resumes

Highlighting in-demand skills on your resume is essential for attracting the attention of recruiters. These competencies can significantly improve your application, and you can find examples of how to effectively showcase them in our curated resume samples.

If these skills align with your background and job expectations, consider incorporating them into your resume:

Active listening

Advising

Conflict resolution

Empathy

Interpersonal communication

Organizational abilities

Problem-solving

Research skills

Team collaboration

Time management

Based on analysis of 5,000+ teaching professional resumes from 2023-2024

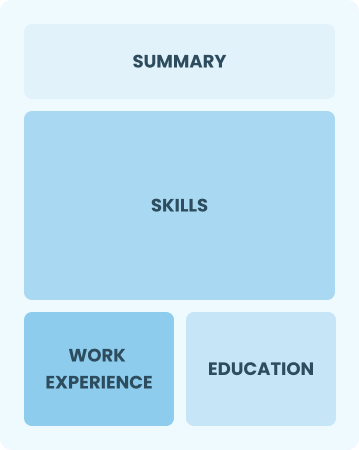

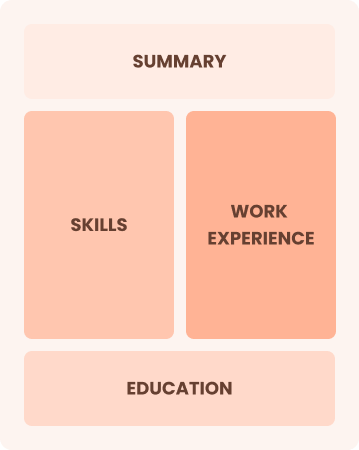

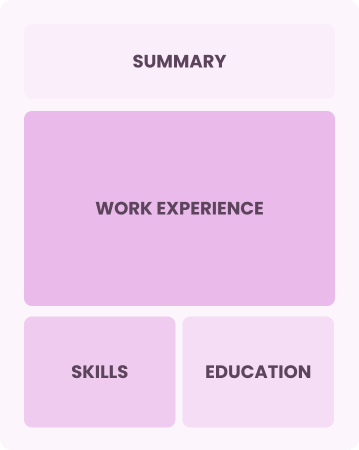

Resume Format Examples

Choosing the right resume format is important for college counselors as it showcases their key skills, relevant experiences, and career growth in a clear and compelling manner.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with limited experience in counseling

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on seeking advancement opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Senior registered nurses leading in advanced patient care management

Frequently Asked Questions

Should I include a cover letter with my college counselor resume?

Absolutely, including a cover letter is essential for showcasing your personality and qualifications to employers. It offers you the chance to explain how your background aligns with the job and highlights your enthusiasm. If you're looking for assistance, take a look at our comprehensive guide on how to write a cover letter or use our Cover Letter Generator for a quick start.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs internationally, use a CV instead of a resume if the employer expects detailed education and work history. To assist you in crafting an effective CV, we offer guidance on how to write a CV along with various CV examples that illustrate proper formatting and best practices.

What soft skills are important for college counselors?

Soft skills like active listening, empathy, and communication are essential for college counselors. These interpersonal skills foster trust with students, enabling them to navigate their academic journeys and personal challenges more effectively.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills like communication, organization, and teamwork. These abilities demonstrate your potential to thrive in a college counseling role, even if your previous experience isn't directly related. Share tangible examples from past jobs or volunteer work that showcase these strengths in action. This approach will help bridge the gap between your history and your future contributions.

How do I write a resume with no experience?

If you’re writing a resume with no experience for a college counselor position, highlight relevant skills such as communication, problem-solving, and empathy. Consider mentioning internships, volunteer work, or leadership roles in school organizations. Your passion for helping students navigate their educational paths will resonate with employers and showcase your potential to make a meaningful impact.

Should I include a personal mission statement on my college counselor resume?

Yes, including a personal mission statement on your resume is recommended. It effectively conveys your values and career aspirations, particularly when applying to organizations that prioritize cultural fit or have a strong commitment to their mission and community engagement.