Hard skills include expertise in communication protocols, conflict resolution strategies, and data management systems essential for ensuring smooth operations between departments.

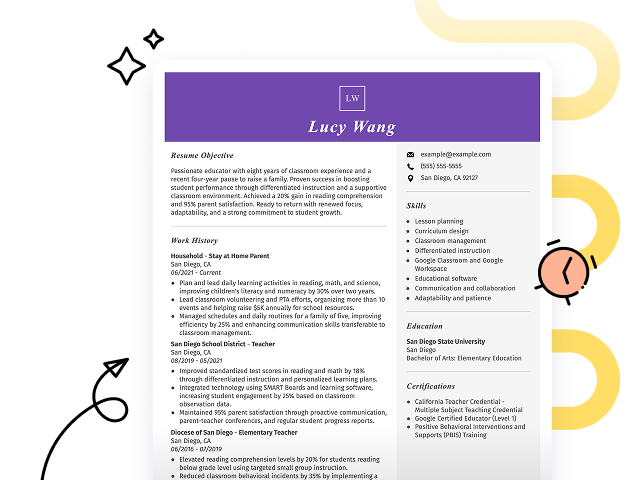

Popular Liaison Officer Resume Examples

Discover our top liaison officer resume examples that emphasize essential skills such as communication, conflict resolution, and relationship management. These examples provide a great foundation for showcasing your unique qualifications effectively.

Ready to build your resume? Our Resume Builder offers user-friendly templates specifically designed to help you shine in your job applications.

Recommended

Entry-level liaison officer resume

This entry-level resume effectively highlights the job seeker's client engagement skills and their ability to improve stakeholder relations through measurable achievements. New professionals in this field must demonstrate strong communication abilities and a proactive approach to relationship management, even with limited work experience.

Mid-career liaison officer resume

This resume clearly showcases the job seeker's qualifications for a liaison officer role, emphasizing strategic communication and project management skills. Their progressive experience demonstrates readiness for complex challenges and leadership opportunities, reflecting a strong capability to improve organizational collaboration.

Experienced liaison officer resume

The work experience section showcases the applicant's significant accomplishments as a liaison officer, including a 30% boost in project efficiency and $50k cost reductions through strategic implementations. The clear format allows hiring managers to quickly identify key achievements, making it effective for competitive job applications.

Resume Template—Easy to Copy & Paste

Jane Patel

Riverview, FL 33582

(555)555-5555

Jane.Patel@example.com

Professional Summary

Dynamic Liaison Officer with 8 years enhancing communication. Expert in project coordination and strategic insight, skilled in cross-department operations.

Work History

Liaison Officer

Precision Solutions Ltd. - Riverview, FL

June 2023 - October 2025

- Facilitated 20% increase in project efficiency

- Coordinated cross-team communication with 15 departments

- Managed budgets over 2M in client engagements

Communication Strategist

Connective Networks Co. - Riverview, FL

June 2019 - May 2023

- Improved client satisfaction by 25% through strategies

- Developed partnership deals worth 1.5M annually

- Led team in delivering 50+ successful projects

Interdepartmental Advisor

Solutions Hub Inc. - Tampa, FL

October 2017 - May 2019

- Enhanced workflow efficiency by 30%

- Orchestrated multi-unit project initiatives

- Streamlined communication protocols organization-wide

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Skills

- Project Coordination

- Cross-Department Communication

- Budget Management

- Client Satisfaction Improvement

- Strategic Insight

- Workflow Optimization

- Team Leadership

- Protocol Development

Certifications

- Certified Strategic Communicator - The Communication Institute

- Professional Liaison Certification - National Liaison Association

Education

Master of Business Administration Business Communication

State University Edu Town, Knowledge State

June 2017

Bachelor of Arts Communication Studies

Community College College City, Study State

June 2015

How to Write a Liaison Officer Resume Summary

Your resume summary is the first thing employers will notice, so it’s important to make a strong impact. As a liaison officer, you should highlight your communication skills and ability to bridge gaps between diverse groups.

In this role, showcasing your problem-solving abilities and experience in building relationships is essential. This can set you apart from other applicants and demonstrate your value.

To better understand what makes an effective liaison officer resume summary, consider the following examples. They will illustrate key elements that work well and those that may not resonate as effectively:

I am a dedicated liaison officer with years of experience in communication and coordination. I seek a position where I can use my expertise to foster relationships and promote collaboration. Ideally, I want to work in an environment that values teamwork and offers room for advancement. I believe I could be a great asset to the organization if given the chance.

- Contains vague phrases about experience without detailing specific skills or accomplishments

- Relies heavily on personal pronouns which detracts from professionalism

- Emphasizes what the job seeker desires from the job rather than highlighting their value to potential employers

Experienced liaison officer with over 7 years in public relations and stakeholder engagement, adept at fostering collaboration between organizations and communities. Spearheaded a community outreach program that increased participation by 40%, improving communication between local government and residents. Proficient in crisis management, strategic planning, and using social media platforms to amplify messaging.

- Begins with clear experience duration and specific role-related expertise

- Highlights a significant achievement with measurable outcomes that illustrate effectiveness

- Demonstrates relevant skills essential for the liaison officer position, showcasing both interpersonal and strategic competencies

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a liaison officer, serving as the main focus and where you’ll provide the bulk of your content. Good resume templates will always emphasize this important area.

This section should be arranged in reverse-chronological order, detailing your previous positions. Use bullet points to highlight specific achievements and contributions that demonstrate your effectiveness in each role.

To aid you in crafting a compelling work history, we’ve prepared two examples that showcase best practices for liaison officers. These examples will clarify what works well and what pitfalls to avoid:

Liaison Officer

City Council – Springfield, IL

- Communicated with various departments

- Attended meetings and took notes

- Helped organize community events

- Responded to emails and inquiries

- No details about the employment dates

- Bullet points lack specifics on achievements or impact

- Focuses on routine tasks instead of highlighting unique contributions or measurable results

Liaison Officer

City Health Department – Los Angeles, CA

March 2020 - Current

- Facilitate communication between local government agencies and community organizations, improving collaboration on public health initiatives

- Organize and lead community outreach programs that increased participation by 40% over two years

- Develop training materials for staff that improved understanding of health policies, resulting in a 30% increase in compliance

- Starts each bullet with compelling action verbs that clearly convey the job seeker's contributions

- Incorporates specific metrics to highlight success and effectiveness in role

- Showcases relevant skills such as communication and program development tied to job responsibilities

While your resume summary and work experience are important components, it’s essential not to overlook other sections that contribute to your overall presentation. For detailed guidance on crafting each part of your resume effectively, explore our extensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for any resume as it allows applicants to quickly showcase their qualifications. It helps employers identify whether you possess the essential abilities needed for the liaison officer role.

For this position, highlight both hard skills and soft skills in your resume to show you're a well-rounded character. Use hard skills to showcase your industry expertise and soft skills to show you have the personal traits to succeed.

Soft skills encompass active listening, adaptability, and relationship-building abilities that foster collaboration and trust, important for effective coordination and support within healthcare teams.

Selecting the right resume skills is important to meet employer expectations and navigate automated screening systems. Many organizations use software to filter out applicants who lack essential skills for the position.

To improve your chances, carefully review job postings for insights on which skills are most valued. This approach ensures that you highlight relevant abilities, making your resume more appealing to both recruiters and ATS systems.

Pro Tip

10 skills that appear on successful liaison officer resumes

Highlighting essential skills in your resume can significantly attract the attention of recruiters looking for liaison officers. Our resume examples showcase how these skills can be effectively presented, ensuring you feel confident when applying for positions.

By the way, here are 10 key skills to consider adding to your resume if they align with your experience and job descriptions:

Interpersonal communication

Problem-solving

Negotiation skills

Cultural awareness

Project management

Conflict resolution

Adaptability

Attention to detail

Strategic planning

Customer service orientation

Based on analysis of 5,000+ administrative professional resumes from 2023-2024

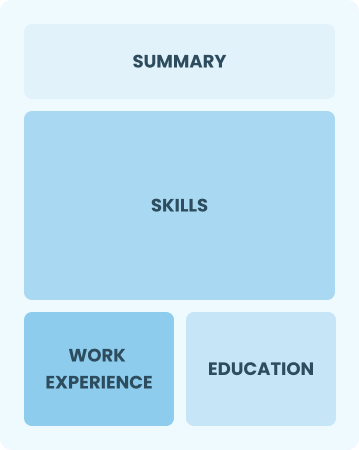

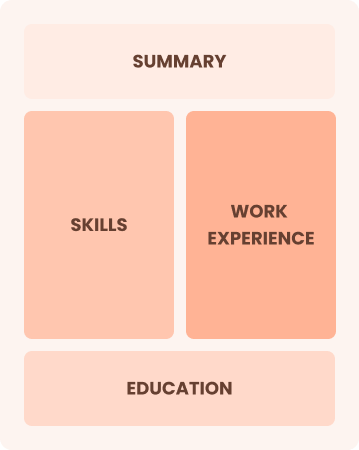

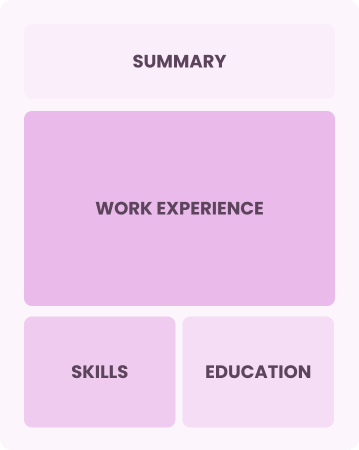

Resume Format Examples

Selecting the appropriate resume format is important for liaison officers, as it effectively showcases your communication skills, relevant experiences, and career growth to potential employers.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with up to two years of experience

Combination

Balances skills and work history equally

Best for:

Professionals showcasing communication skills and growth in liaison roles

Chronological

Emphasizes work history in reverse order

Best for:

Experienced leaders adept at strategic communication and stakeholder engagement

Frequently Asked Questions

Should I include a cover letter with my liaison officer resume?

Absolutely, including a cover letter is essential for making a positive impression on employers. It allows you to showcase your personality and explain how your skills align with the job. For tips on crafting an effective cover letter, explore our detailed guide on how to write a cover letter or use our Cover Letter Generator for quick and easy assistance.

Can I use a resume if I’m applying internationally, or do I need a CV?

For international job applications, use a CV when the employer specifically requests it or when applying in regions where CVs are standard, such as Europe. To assist you, explore our comprehensive guides on how to write a CV and templates that illustrate effective CV formatting and writing techniques tailored for global opportunities. Additionally, review various CV examples to understand different styles and formats.

What soft skills are important for liaison officers?

Soft skills such as communication, negotiation, and empathy are essential for liaison officers. These interpersonal skills foster strong relationships with stakeholders and ensure effective coordination between different parties, leading to smoother operations and successful collaborations.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as communication, organization, and conflict resolution when applying for a liaison officer role. These abilities show your potential to thrive in the position, even if you lack direct experience. Share specific examples from your previous roles to demonstrate how you've successfully navigated challenges and collaborated with diverse teams.

Where can I find inspiration for writing my cover letter as a liaison officer?

For individuals pursuing liaison officer positions, exploring professional cover letter examples can be incredibly beneficial. These samples offer valuable insights into effective content ideas and formatting, helping you present your qualifications in a compelling way that resonates with employers.

How do I add my resume to LinkedIn?

To increase your resume's visibility on LinkedIn, add your resume to LinkedIn directly to your profile or highlight essential skills and experiences in the "About" and "Experience" sections. This approach helps recruiters and hiring managers quickly identify qualified liaison officers, improving your chances of being noticed for relevant opportunities.