Understanding hard skills is essential for an assistant role, as these include proficiency with office software, scheduling systems, data entry, and organizational tasks to ensure smooth and accurate support for daily operations.

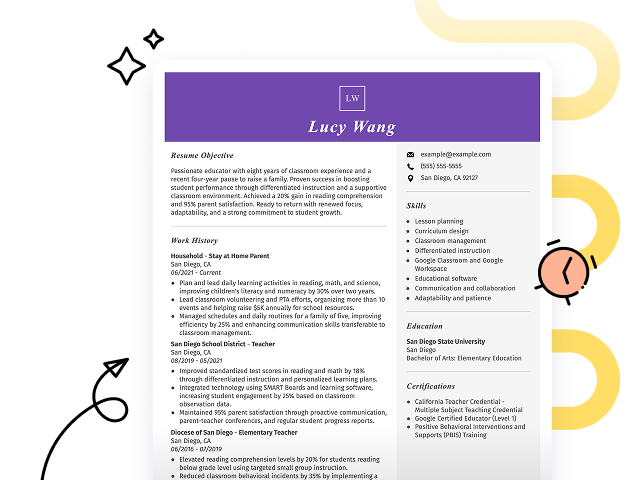

Popular Assistant Resume Examples

Check out our top resume examples for assistants, showcasing critical skills like organization, communication, and problem-solving. These templates are designed to help you effectively highlight your strengths.

Ready to build your own impressive resume? Our Resume Builder offers user-friendly templates specifically crafted to help assistants shine in their job applications.

Recommended

Entry-level assistant resume

This entry-level resume for assistants resume highlights the candidate’s proactive attitude and focus on improving workplace efficiency, emphasizing key skills and a strong commitment to supporting team and client needs. New professionals should showcase their practical abilities and dedication to quality service through relevant experiences, even with limited direct job history.

Mid-career assistant resume

This resume effectively showcases the applicant’s readiness for greater responsibilities by highlighting achievements and certifications. The focus on efficiency improvements and strategic planning shows their potential for leadership roles and complex challenges.

Experienced assistant resume

This resume's work history section demonstrates the applicant's robust experience in administrative roles, highlighting their ability to improve operational efficiency, evidenced by a 30% reduction in wait times and $50,000 in annual savings. The clear formatting improves readability for hiring managers seeking quantifiable contributions.

Resume Template—Easy to Copy & Paste

Hiro Lee

Brookfield, WI 53009

(555)555-5555

Hiro.Lee@example.com

Professional Summary

Dedicated assistant with 4 years of experience. Expertise in client management, communication, and organization. Adept at improving operational efficiency and client satisfaction rates.

Work History

Assistant

BrightPath Caregiving - Brookfield, WI

January 2023 - January 2025

- Increased client satisfaction by 20%.

- Managed schedules for 15+ daily appointments.

- Facilitated client communication improving retention.

Office Support Specialist

Serenity Care Solutions - Brookfield, WI

January 2021 - December 2022

- Reduced operational errors by 25%.

- Handled client inquiries, boosting engagement.

- Streamlined file organization saving 10% time.

Administrative Coordinator

Golden Years Home Care - Brookfield, WI

January 2019 - December 2020

- Improved filing system efficiency by 30%.

- Coordinated meetings for 20+ personnel.

- Optimized data entry reducing errors by 15%.

Skills

- Client Management

- Communication Skills

- Time Management

- Data Entry

- Organizational Skills

- Problem-Solving

- Multitasking

- Microsoft Office

Certifications

- Professional Administrative Certificate of Excellence - International Association of Administrative Professionals

- Certified Office Assistant - National Career Certification Board

Education

Master of Arts Communication

University of Southern California Los Angeles, California

May 2018

Bachelor of Arts English Literature

California State University Los Angeles, California

May 2016

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

How to Write an Assistant Resume Summary

Your resume summary is the first impression you give to hiring managers, making it important to capture their attention immediately. This section should clearly demonstrate your qualifications and suitability for the role.

As an assistant, you should highlight your leadership skills, experience in team collaboration, and ability to drive results. These elements are key to showcasing your readiness to contribute effectively.

To better illustrate what makes an effective summary, consider these examples that will clarify effective versus ineffective approaches:

I am looking for an assistant job because I like helping people and want to grow in my career. I am a hard worker and enjoy being part of a team. I hope to do well and make a positive contribution if given the opportunity.

- Lacks specific achievements or quantifiable results, making it hard to gauge the job seeker's impact

- Overuses personal language, emphasizing what the job seeker desires rather than their contributions

- Does not highlight key skills or experiences relevant to the role, reducing its effectiveness

Accomplished assistant with over 7 years of experience in executive office settings, known for optimizing organizational efficiency and improving executive productivity. Successfully managed scheduling for a team of 5 executives, reducing scheduling conflicts by 20%. Proficient in Microsoft Office Suite, project management software, and executing high-stakes administrative tasks under tight deadlines.

- Begins with clearly defined years of experience and work environment

- Highlights a quantifiable achievement that shows the applicant’s organizational impact

- Mentions specific technical skills that are important for an assistant role

Pro Tip

Showcasing Your Work Experience

The work experience section is critical in your resume as a registered nurse, containing the majority of your content. A well-structured resume template will always emphasize this section to ensure it stands out.

Organize this part of your resume in reverse-chronological order, listing your previous positions. Use bullet points to highlight specific achievements and contributions in each of your nursing roles.

To help you visualize what an effective work history looks like, we’ll present some examples that illustrate best practices and common pitfalls:

Assistant

Tech Solutions Inc. – Austin, TX

- Helped with office tasks.

- Answered phones and emails.

- Collaborated with team members.

- Participated in meetings.

- Lacks specific tasks or outcomes

- Bullet points are too generic and do not highlight skills or achievements

- Doesn't showcase the job seeker's impact or contributions to the team

Assistant

Tech Innovations LLC – San Francisco, CA

March 2020 - Current

- Support daily office operations for a team of 50+ staff, ensuring smooth workflow and organization

- Coordinate schedules, meetings, and correspondence to improve efficiency and communication

- Assist with project tracking and document management, helping reduce delays in task completion

- Starts each bullet with powerful action verbs that clearly outline the job seeker’s contributions

- Incorporates specific metrics to quantify achievements, showcasing real impact on business growth

- Highlights relevant skills demonstrating the job seeker’s versatility and initiative

While your resume summary and work experience are critical components, don’t overlook the importance of other sections. Each part plays a role in showcasing your qualifications. For more detailed insights, be sure to explore our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A well-defined skills section allows hiring managers to quickly assess your qualifications and match them with the job requirements.

For an administrative assistant, highlight both hard skills and soft skills. Hard skills demonstrate your knowledge and areas of expertise, while soft skills ensure employers of your interpersonal abilities.

Equally important are soft skills, including communication, teamwork, and interpersonal abilities, which help build strong relationships with colleagues, support smooth collaboration, and ensure an efficient and positive work environment.

When selecting resume skills, you must align them with what employers expect and the criteria set by automated screening systems. This ensures your application stands out and meets the basic requirements for the position.

To determine which skills to highlight, closely examine job postings related to your target role. They often contain specific keywords that can guide you in prioritizing the most relevant abilities for both recruiters and ATS screenings.

Pro Tip

10 skills that appear on successful assistant resumes

Highlighting in-demand skills can significantly increase your chances of catching a recruiter's eye. You can see examples of these skills effectively showcased in our resume examples, ensuring you present yourself as a confident job seeker.

By the way, if you find that any of these skills align with your experience and job requirements, make sure to include them on your resume:

Attention to detail

Team collaboration

Time management

Problem-solving

Technical skill

Customer service orientation

Adaptability

Sales techniques

Data analysis

Project management

Based on analysis of 5,000+ administrative professional resumes from 2023-2024

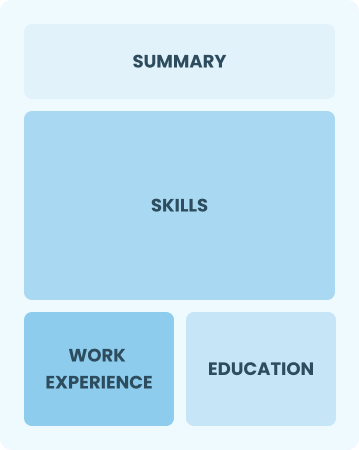

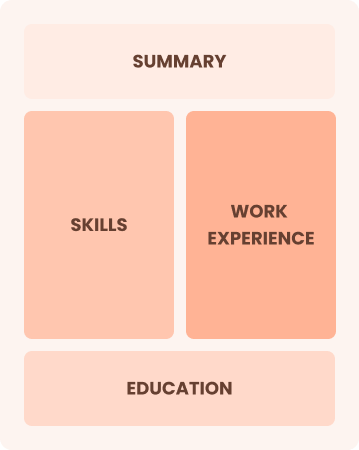

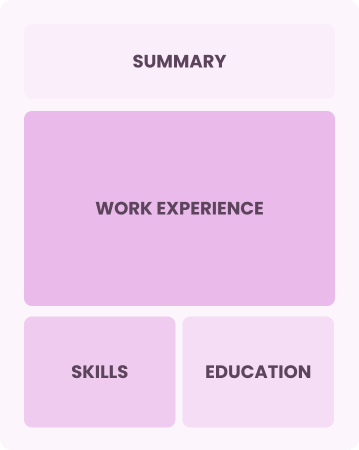

Resume Format Examples

Choosing the resume format that best suits your experience lets you highlight your key skills, relevant background, and career progressions, making your application stand out to prospective employers.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and those pivoting careers with limited experience

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating their skills and pursuing new opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Seasoned nurses excelling in leadership and specialized care roles

Assistant Salaries in the Highest-Paid States

Our assistant salary data is based on figures from the U.S. Bureau of Labor Statistics (BLS), the authoritative source for employment trends and wage information nationwide.

Whether you're entering the workforce or considering a move to a new city or state, this data can help you gauge what fair compensation looks like for assistants in your desired area.

Frequently Asked Questions

Should I include a cover letter with my assistant resume?

Absolutely, including a cover letter is a great way to improve your application. It allows you to highlight your relevant skills and convey your enthusiasm for the position. If you're looking for tips on crafting an effective cover letter, explore our comprehensive guide on how to write a cover letter. Alternatively, you can use our Cover Letter Generator for quick assistance.

Can I use a resume if I’m applying internationally, or do I need a CV?

A CV is often necessary when applying for jobs outside the U.S., especially in Europe and Asia. It’s more comprehensive than a resume and emphasizes academic achievements. To ensure your application meets international expectations, explore our resources for CV examples and learn how to write a CV with effective templates and tips.

What soft skills are important for assistants?

Soft skills like organization, and attention to detail are essential for an assistant. These interpersonal skills foster trust with patients and ensure seamless teamwork in the operating room, ultimately improving patient care and safety.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills like communication, teamwork, and adaptability when applying for Assistant roles. These abilities demonstrate your readiness to excel, even if you lack direct experience in the field. Use real-life examples from previous jobs to illustrate how your strengths align with the responsibilities of the new position.

Where can I find inspiration for writing my cover letter as a assistant?

For those applying for assistant positions, professional cover letter examples can be invaluable. They provide inspiration for content ideas, help with formatting, and showcase how to effectively present your qualifications. Using these samples can improve your application and increase your chances of standing out to employers.

Should I include a personal mission statement on my assistant resume?

Yes, adding a personal mission statement to your resume is beneficial. It effectively showcases your core values and aspirations, which can resonate with employers who prioritize cultural fit or have a mission-driven approach. This strategy is particularly compelling for nonprofit organizations or healthcare settings.