Hard skills are technical abilities like financial analysis, understanding credit risk, and skill in loan processing software that are essential for evaluating and managing commercial loans.

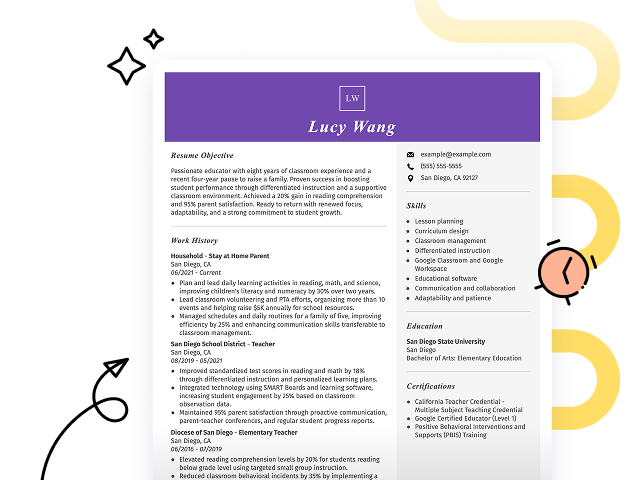

Popular Commercial Loan Officer Resume Examples

Check out our top commercial loan officer resume examples that emphasize key skills such as financial analysis, client relations, and negotiation expertise. These examples will help you effectively showcase your achievements to potential employers.

Ready to build your ideal resume? Our Resume Builder offers user-friendly templates specifically crafted for finance professionals, making your job application process smooth and efficient.

Recommended

Entry-level commercial loan officer resume

This entry-level resume for a commercial loan officer effectively highlights the job seeker's key achievements in financial lending, including significant revenue generation and improved loan approval rates. New professionals in this field must demonstrate their analytical skills, client relationship abilities, and relevant certifications to attract potential employers despite having limited work experience.

Mid-career commercial loan officer resume

This resume effectively showcases essential qualifications, emphasizing achievements in portfolio growth and compliance. The clear progression from financial service representative to loan officer demonstrates the job seeker's readiness for greater responsibilities and leadership roles in commercial lending.

Experienced commercial loan officer resume

This work experience section demonstrates the applicant's strong background as a commercial loan officer, highlighting their success in managing $10M loans and increasing the client base by 20%. The bullet points effectively showcase achievements, making it easy for hiring managers to assess qualifications at a glance.

Resume Template—Easy to Copy & Paste

John Chen

Tacoma, WA 98402

(555)555-5555

John.Chen@example.com

Professional Summary

Results-driven Commercial Loan Officer with expertise in financial analysis, risk management, and client relations, consistently achieving portfolio growth and high client retention. Proven leader in loan portfolio and credit assessment.

Work History

Commercial Loan Officer

National Finance Group - Tacoma, WA

January 2024 - October 2025

- Increased loan portfolio by 15% in first year

- Conducted financial analysis to approve loans

- Built relationships with 50+ clients

Senior Credit Analyst

Midwest Banking Solutions - Eastside, WA

January 2022 - December 2023

- Analyzed loan applications for 20M portfolio

- Reduced default rate by 10% through risk assessment

- Trained junior analysts, improving efficiency

Loan Processor

Citywide Lending - Silverlake, WA

January 2021 - December 2021

- Processed 200+ loan applications with 98% accuracy

- Streamlined approval process, cut time by 25%

- Assisted in processing M worth of loans

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

Skills

- Commercial Lending

- Financial Analysis

- Risk Assessment

- Client Relationship Management

- Loan Portfolio Management

- Credit Analysis

- Problem Solving

- Team Leadership

Certifications

- Certified Commercial Loan Officer - National Banking Institute

- Certified Credit Analyst - American Bankers Association

Education

Master of Business Administration Finance

University of Chicago Chicago, Illinois

June 2020

Bachelor of Science Business Administration

Michigan State University East Lansing, Michigan

June 2018

How to Write a Commercial Loan Officer Resume Summary

Your resume summary is the first thing employers notice, making it important for creating a positive impression. As a commercial loan officer, you should highlight your financial acumen and relationship-building skills to stand out effectively.

This profession requires showcasing your experience in evaluating loan applications, understanding client needs, and providing tailored financial solutions. These key qualifications will resonate with hiring managers looking for applicants who can drive business growth.

To illustrate what makes a strong resume summary for this role, here are some examples that will clarify effective practices and common pitfalls:

I am a dedicated commercial loan officer with years of experience in the financial sector. I seek a position that allows me to use my skills and contribute positively to the company. A supportive environment where I can grow professionally is very important to me. I believe I could be an asset to your team if given the chance.

- Lacks specific achievements or skills relevant to commercial lending, making it vague

- Emphasizes the applicant’s desires rather than their contributions, which does not appeal to employers

- Uses generic terms like "dedicated" without illustrating what that means in practical terms for lenders

Results-driven commercial loan officer with 7+ years of experience in underwriting and managing a diverse portfolio of loans exceeding $50 million. Successfully increased loan approval rates by 20% through improved risk assessment strategies and client relationship management. Proficient in financial analysis, credit evaluation, and using advanced lending software to streamline processes.

- Begins with specific experience level and key areas of expertise

- Highlights quantifiable achievements that showcase direct impact on business outcomes

- Includes relevant technical skills essential for success in commercial lending

Pro Tip

Showcasing Your Work Experience

The work experience section is the cornerstone of your resume as a commercial loan officer. Effective resume templates always emphasize this important section, which will contain the bulk of your content.

This section should be organized in reverse-chronological order, detailing your previous roles. Use bullet points to highlight your achievements and the impact you’ve made in each position.

Now, let’s look at a couple of examples that will clarify what works well and what doesn’t in showcasing your work history:

Commercial Loan Officer

First National Bank – Chicago, IL

- Assisted with loan applications.

- Communicated with clients.

- Prepared documents for approval.

- Worked on various tasks as needed.

- Lacks specific employment dates to provide context

- Bullet points are vague and do not showcase any strengths or achievements

- Focuses on basic responsibilities instead of highlighting quantifiable results

Commercial Loan Officer

First National Bank – Denver, CO

March 2020 - Current

- Evaluate and approve commercial loan applications, resulting in a 30% increase in loan volume over the past year.

- Develop strong relationships with clients and follow up on leads, contributing to a 40% boost in client retention rates.

- Analyze financial statements and credit reports to assess risk, achieving an average loan default rate of less than 1%.

- Uses action verbs like evaluate and develop to highlight achievements clearly

- Incorporates specific metrics that demonstrate growth and effectiveness in the role

- Showcases essential skills such as risk assessment and relationship building relevant to commercial lending

While your resume summary and work experience sections are important, don't overlook the significance of other elements like skills and certifications. Each part of your resume plays a role in showcasing your qualifications. For more detailed guidance, refer to our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important on your resume as it allows you to quickly demonstrate your qualifications to potential employers. This focused area helps highlight your technical skills and makes it easier for hiring managers to see if you fit the role.

For a commercial loan officer, emphasize both interpersonal abilities and technical skills. Highlight tools like credit analysis systems, financial modeling applications, and loan origination software to showcase your expertise in managing complex financial transactions. Mention soft skills such as perceptive due diligence, persuasive negotiation with business owners, and clear, transparent communication to build long-term trust.

Soft skills, such as communication, negotiation, and relationship-building, are interpersonal qualities that foster trust with clients and facilitate effective teamwork in achieving financial goals.

Selecting the right resume skills is important for standing out to employers and passing automated screening systems. Tailoring your skills to align with what employers expect increases your chances of making a strong impression.

To effectively prioritize your skills, review job postings related to your desired role. These listings often highlight key qualifications that recruiters and ATS systems look for in potential job seekers, helping you refine your resume accordingly.

Pro Tip

10 skills that appear on successful commercial loan officer resumes

Elevate your resume to attract recruiters by highlighting essential skills that are highly sought after in the commercial loan officer field. You can observe how these skills are presented in our resume examples, allowing you to apply for jobs with a polished and professional impression.

Here are 10 skills to consider incorporating into your resume if they align with your experience and job specifications:

Financial analysis

Customer service

Attention to detail

Negotiation skills

Risk assessment

Knowledge of lending regulations

Communication skill

Time management

Problem-solving abilities

Relationship building

Based on analysis of 5,000+ finance professional resumes from 2023-2024

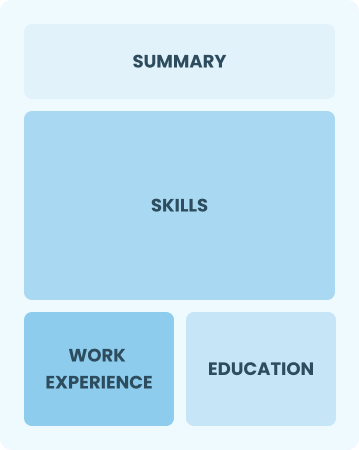

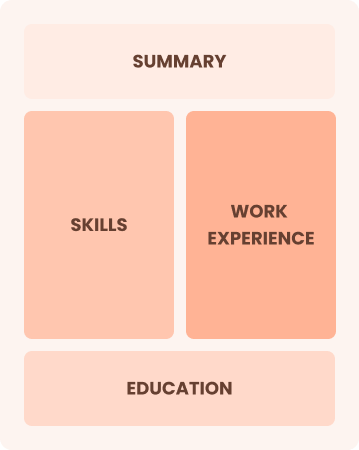

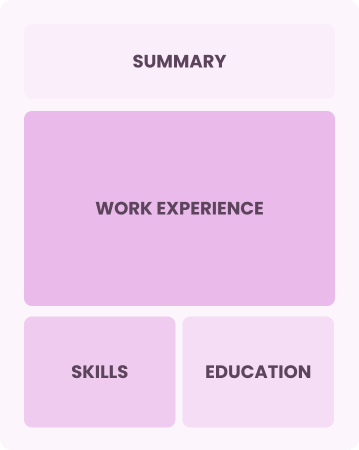

Resume Format Examples

Selecting the appropriate resume format for a commercial loan officer is important as it showcases your financial expertise, relevant experience, and career growth in a clear and strong way.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with zero to two years of experience

Combination

Balances skills and work history equally

Best for:

Mid-career professionals focused on demonstrating their skills and potential for growth

Chronological

Emphasizes work history in reverse order

Best for:

Seasoned experts in complex commercial financing and client relationship management

Frequently Asked Questions

Should I include a cover letter with my commercial loan officer resume?

Absolutely, including a cover letter can improve your application by showcasing your personality and qualifications. It offers you the chance to explain why you're a great fit for the role and to highlight specific achievements. If you need assistance, check out our resources on how to write a cover letter or use our Cover Letter Generator for quick help.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for international positions, a CV is often necessary instead of a resume. A CV provides a comprehensive view of your academic and professional history. Explore our CV examples to learn about proper formatting and crafting an effective document. Additionally, you can discover tips on how to write a CV tailored for global opportunities.

What soft skills are important for commercial loan officers?

Soft skills like active listening, negotiation, and relationship-building are essential for commercial loan officers. These interpersonal skills foster trust with clients and improve collaboration with colleagues, ultimately leading to successful loan processing and satisfied customers.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as financial analysis, customer service, and negotiation. Even if you lack direct experience in commercial lending, these abilities demonstrate your potential to excel in the role. Use concrete examples from past jobs to illustrate how you've successfully managed client relationships or navigated complex financial scenarios.

Where can I find inspiration for writing my cover letter as a commercial loan officer?

Job seekers aiming for commercial loan officer positions should explore our curated collection of professional cover letter examples. These samples provide valuable insights into effective content ideas, formatting tips, and ways to showcase your qualifications that can set you apart in the application process.

Should I use a cover letter template?

Yes, using a cover letter template specifically tailored for commercial loan officers can improve your document's structure and organization. This allows you to effectively highlight key skills such as financial analysis, risk assessment, and client relationship management that are important for impressing hiring managers.