Hard skills are essential technical abilities such as knowledge of regulatory compliance, risk assessment, and data analysis that a KYC AML analyst must demonstrate effectively.

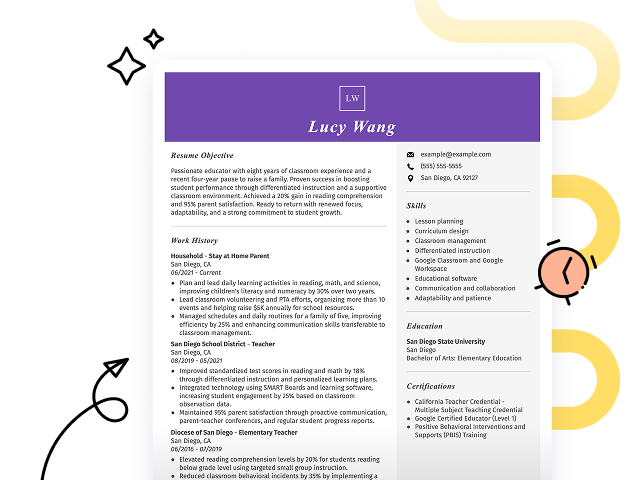

Popular KYC AML Analyst Resume Examples

Check out our top KYC AML analyst resume examples that emphasize critical skills such as risk assessment, regulatory compliance, and analytical thinking. These examples illustrate how to effectively showcase your qualifications to potential employers.

Ready to build your unique resume? Our Resume Builder offers user-friendly templates designed specifically for compliance professionals, helping you highlight your strengths with ease.

Recommended

Entry-level KYC AML analyst resume

This entry-level resume for a KYC AML Analyst effectively highlights the applicant's analytical skills and significant accomplishments in compliance roles, showcasing their ability to conduct thorough risk assessments and improve regulatory adherence. New professionals must demonstrate relevant technical skills and a clear understanding of compliance processes to appeal to potential employers, even with limited direct experience.

Mid-career KYC AML analyst resume

This resume effectively showcases key qualifications through a structured presentation of achievements and responsibilities. The job seeker’s extensive experience in compliance and risk assessment indicates readiness for advanced roles, reflecting a strong career trajectory in the financial sector.

Experienced KYC AML analyst resume

This work history section effectively showcases the applicant's robust experience as a KYC AML Analyst, highlighting a 20% reduction in alerts and monthly reviews of over 500 transactions for compliance. The clear formatting allows hiring managers to quickly assess key achievements and qualifications.

Resume Template—Easy to Copy & Paste

Olivia Lee

St. Louis, MO 63106

(555)555-5555

Olivia.Lee@example.com

Professional Summary

Detail-oriented KYC AML Analyst with 9 years of expertise in financial crime prevention, risk assessment, and compliance monitoring. Proven track record of reducing operational errors and regulatory fines through innovative strategies and data-driven solutions. Skilled in leveraging industry tools to streamline workflows and ensure adherence to global compliance standards.

Work History

KYC AML Analyst

Integrity Financial Solutions - St. Louis, MO

January 2022 - October 2025

- Reviewed 100+ client profiles weekly for compliance.

- Reduced KYC review time by 30% using automated tools.

- Identified 15 potential AML risks monthly with enhanced due diligence.

AML Compliance Specialist

Global Trade Compliance Corp. - St. Louis, MO

January 2017 - January 2022

- Audited customer accounts, minimizing risk by 25% quarterly.

- Assisted in detecting regulatory breaches, preserving M in fines.

- Implemented AML policies, improving compliance by 40%.

Financial Crime Analyst

Pinnacle Bank Group - St. Louis, MO

January 2014 - January 2017

- Analyzed 50 client transactions daily for money laundering patterns.

- Flagged suspicious activity, preventing 1.5M in fraud annually.

- Trained 20 peers to identify and escalate high-risk cases.

Skills

- KYC/AML Compliance

- Financial Crime Investigations

- Fraud Prevention

- Regulatory Reporting

- Risk Assessment

- Transaction Monitoring

- Data Analytics Tools (e.g., SQL, Python)

- Cross-functional Collaboration

Certifications

- Certified Anti-Money Laundering Specialist (CAMS) - ACAMS

- KYC Compliance Certification - Global Compliance Institute

Education

Master's Degree Finance

University of Chicago Chicago, IL

June 2013

Bachelor's Degree Economics

New York University New York, NY

May 2011

Languages

- Spanish - Beginner (A1)

- French - Intermediate (B1)

- German - Beginner (A1)

How to Write a KYC AML Analyst Resume Summary

Your resume summary is the first thing employers will see, making it important to present a compelling introduction. As a KYC AML analyst, you should highlight your analytical skills and knowledge of compliance regulations to capture attention right away. The following examples will illustrate effective strategies for crafting a standout resume summary that clearly communicates your qualifications and suitability for the role:

I am a dedicated KYC AML analyst with experience in compliance and risk management. I am searching for a job that allows me to apply my skills effectively and contribute positively to the company’s success. A team-oriented environment where I can grow is what I'm looking for.

- Contains vague language about skills and experience, failing to provide concrete examples of expertise

- Emphasizes personal desires rather than highlighting what value the job seeker brings to potential employers

- Lacks specificity regarding achievements or contributions, making it difficult for recruiters to gauge qualifications

Detail-oriented KYC AML Analyst with 4 years of experience in financial compliance and risk management. Successfully identified and reported suspicious activity, contributing to a 20% increase in regulatory compliance audits pass rate. Proficient in data analysis tools such as SAS and SQL, as well as implementing AML policies and procedures to mitigate risks.

- Begins with specific experience level and area of expertise

- Highlights quantifiable achievements that demonstrate a direct impact on compliance metrics

- Includes relevant technical skills that are critical for success in KYC AML roles

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a KYC AML analyst, as it will contain the majority of your content. Good resume templates always place emphasis on this key section to highlight your professional journey.

This area should be organized in reverse-chronological order, allowing you to present your previous roles clearly. Using bullet points helps detail your achievements and contributions in each position effectively.

Now, let’s explore a couple of examples that demonstrate effective work history entries for KYC AML analysts. These examples will help illustrate what makes a strong entry and what pitfalls to avoid:

KYC AML Analyst

Global Finance Corp – New York, NY

- Reviewed customer information.

- Conducted background checks.

- Filled out forms and reports.

- Communicated with team members.

- Lacks specific details about the tasks performed

- Bullet points do not highlight any achievements or impacts

- Focuses on basic responsibilities rather than demonstrating expertise in KYC/AML compliance.

KYC AML Analyst

Global Finance Corp – New York, NY

March 2020 - Current

- Conduct thorough due diligence on high-risk clients, improving compliance accuracy by 30% through detailed risk assessments.

- Collaborate with regulatory teams to streamline reporting processes, reducing report preparation time by 40%.

- Train new analysts on KYC protocols and AML regulations, improving team efficiency and knowledge retention.

- Starts each bullet with powerful action verbs that showcase the applicant's contributions

- Incorporates specific metrics to highlight improvements and achievements

- Demonstrates relevant skills in KYC and AML while showcasing the impact of teamwork and training

While your resume summary and work experience are important components, don't overlook the importance of other sections. Each part plays a role in showcasing your qualifications effectively. For detailed guidance on crafting a standout resume, refer to our how to write a resume comprehensive guide.

Top Skills to Include on Your Resume

A well-defined skills section is important for any effective resume. It allows potential employers to quickly assess whether your abilities align with the requirements of the KYC AML analyst role.

For this position, you should emphasize technical skills such as data analysis and risk assessment, highlighting skill in tools like SAS, SQL, or specialized compliance software. Showcasing these skills can set you apart from other job seekers. Key soft skills to mention are meticulous attention to detail to uncover suspicious patterns, unyielding ethical integrity to enforce compliance rules impartially, and clear, disciplined communication to document findings and articulate risk to stakeholders.

Soft skills, including attention to detail, analytical thinking, and strong communication, play an important role in building trust and ensuring collaborative efforts in preventing financial crimes.

When selecting your resume skills, it’s important to align them with what employers expect from job seekers. Many organizations use automated screening systems that filter applicants based on the required skills for the role.

To ensure your resume stands out, review job postings carefully for hints on which skills are most relevant. Highlighting these key competencies will not only attract recruiters but also help you pass through ATS filters effectively.

Pro Tip

10 skills that appear on successful KYC AML analyst resumes

Highlighting your skills as a KYC AML analyst can significantly improve your resume and capture the attention of hiring managers. You’ll find these vital skills demonstrated in our resume samples, allowing you to apply for positions with greater confidence.

By the way, consider incorporating relevant skills from this list that align with your experience and job descriptions:

Analytical thinking

Attention to detail

Risk assessment

Regulatory knowledge

Data analysis

Problem-solving abilities

Communication skills

Team collaboration

Time management

Technical skill in compliance software

Based on analysis of 5,000+ industrial engineering professional resumes from 2023-2024

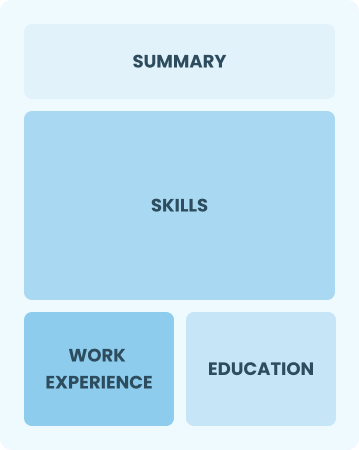

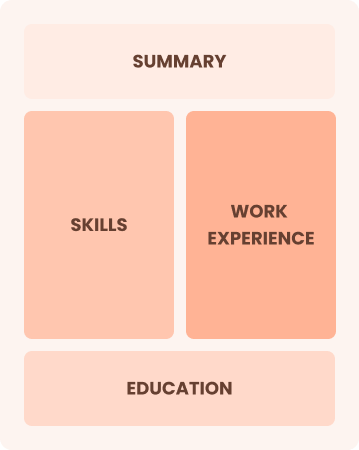

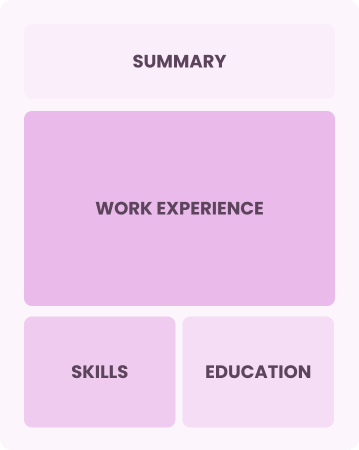

Resume Format Examples

Selecting the appropriate resume format is important for a KYC AML analyst as it showcases your analytical skills, compliance experience, and professional growth in a clear and powerful way.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with up to two years of experience

Combination

Balances skills and work history equally

Best for:

Mid-career analysts focused on showing their skills and pursuing growth opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Experts in compliance and risk management leadership roles

Frequently Asked Questions

Should I include a cover letter with my KYC AML analyst resume?

Absolutely, including a cover letter is important for making a strong impression on recruiters. It allows you to highlight your relevant skills and show genuine interest in the position. If you're looking for tips on how to write a cover letter, our resources can guide you through the process. Try our Cover Letter Generator to create a personalized letter quickly and easily.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs abroad, use a CV instead of a resume to provide a comprehensive overview of your qualifications and experiences. To ensure your CV meets international standards, explore CV examples that showcase effective formatting. Additionally, review our guide on how to write a CV to create content tailored to global employers.

What soft skills are important for KYC AML analysts?

Soft skills such as analytical thinking, attention to detail, and communication are essential for KYC AML analysts. These interpersonal skills play a key role in assessing risks effectively, working seamlessly with teams, and conveying findings clearly, all of which strengthen the compliance environment.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as analytical thinking, attention to detail, and communication. These abilities are important in KYC and AML roles, showcasing your potential despite limited direct experience. Share specific examples from previous positions that illustrate how you managed risks or ensured compliance. This approach demonstrates your readiness to succeed in this field.

How should I format a cover letter for a KYC AML analyst job?

To format a cover letter for a KYC AML analyst, include your contact details, a respectful greeting, and an engaging introduction. Highlight relevant skills and experiences that match the job description. Conclude with a call to action, expressing enthusiasm for the role.

Should I include a personal mission statement on my KYC AML analyst resume?

Including a personal mission statement in your resume is recommended. It effectively showcases your values and career aspirations. This approach shines when applying to companies that prioritize integrity and social responsibility, as it aligns your goals with their organizational culture.