The skill of analyzing financial documents, understanding credit regulations, and using hard skills like risk assessment techniques is essential for evaluating mortgage applications.

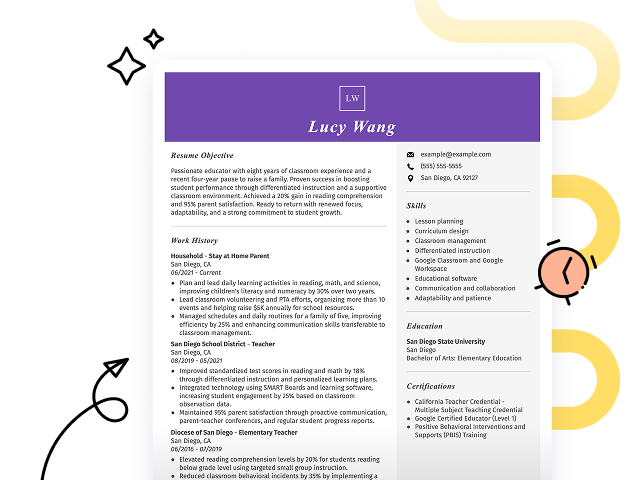

Popular Mortgage Underwriter Resume Examples

Check out our top mortgage underwriter resume examples that emphasize critical skills such as risk assessment, analytical thinking, and decision-making. These examples showcase how to effectively present your expertise to potential employers.

Need a professional resume fast? Our Resume Builder offers customizable templates designed specifically for financial professionals like you.

Recommended

Entry-level mortgage underwriter resume

This entry-level resume for a mortgage underwriter effectively highlights the job seeker's analytical skills and achievements in processing loan applications. It showcases their ability to optimize underwriting processes and reduce defaults. New professionals in this field must demonstrate strong financial analysis capabilities and a commitment to accuracy through their resumes, even with limited work experience.

Mid-career mortgage underwriter resume

This resume effectively emphasizes key qualifications, showcasing a mix of experience and accomplishments. The clear progression from credit risk specialist to mortgage underwriter illustrates the applicant's readiness for advanced responsibilities and leadership in the financial sector.

Experienced mortgage underwriter resume

The work history section illustrates the applicant’s extensive experience as a mortgage underwriter, emphasizing their ability to approve 95% of loan applications and decrease default rates by 20%. The use of bullet points improves readability, making it easy for hiring managers to quickly assess their qualifications.

Resume Template—Easy to Copy & Paste

David Liu

Chicago, IL 60607

(555)555-5555

David.Liu@example.com

Skills

- Mortgage underwriting

- Credit analysis

- Financial modeling

- Risk assessment

- Loan processing

- Regulatory compliance

- Data analysis

- Customer service

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Beginner (A1)

Professional Summary

Experienced mortgage underwriter with expertise in credit analysis, financial modeling, and risk assessment. Proven ability to streamline loan processes, increase approval rates, and enhance accuracy. Strong skills in customer service and regulatory compliance.

Work History

Mortgage Underwriter

Atlas Credit Solutions - Chicago, IL

December 2024 - December 2025

- Reviewed 200+ mortgage applications monthly

- Increased loan approval rate by 15%

- Reduced processing time by 20% through automation

Loan Processor

Gateway Lending Group - Chicago, IL

December 2023 - November 2024

- Processed 150+ applications monthly

- Enhanced accuracy by 25% through system audits

- Streamlined document verification, saving 10 hours/week

Credit Analyst

Summit Financial Insights - Springfield, IL

December 2021 - November 2023

- Assessed credit reports for 300+ clients

- Improved rating accuracy by 30%

- Trained 5 new analysts on credit analysis

Certifications

- Certified Mortgage Underwriter - National Association of Mortgage Processors

- Certified Financial Analyst - Global Finance Certification Institute

Education

Master's in Finance Finance

Northeastern University Boston, MA

June 2021

Bachelor of Science Economics

University of California Berkeley, CA

June 2019

How to Write a Mortgage Underwriter Resume Summary

Your resume summary is the first impression employers have of you, making it important to craft a compelling introduction. As a mortgage underwriter, you should highlight your analytical skills and attention to detail that are essential in assessing loan applications.

This section is your opportunity to showcase your experience and qualifications relevant to underwriting. Focus on your ability to evaluate risk and make informed decisions based on financial data.

To help you understand what makes an effective summary, here are some examples that illustrate both successful elements and common pitfalls:

I am an experienced mortgage underwriter seeking a position where I can use my skills and contribute to the company’s success. I hope to work in a supportive environment that values employee development and offers chances for advancement. I believe my background would be an asset to your team.

- Lacks specific achievements or metrics related to mortgage underwriting

- Focuses heavily on personal desires rather than how the applicant can benefit the employer

- Uses vague phrases like "experienced" without detailing relevant skills or experiences

Detail-oriented mortgage underwriter with 7+ years of experience in assessing loan applications and mitigating risk. Improved approval efficiency by 20% through streamlined processes and improved data analysis skills, resulting in a significant reduction in turnaround times. Proficient in using automated underwriting systems, credit analysis, and regulatory compliance to ensure quality loan origination.

- Begins with clear experience level and specific industry focus

- Highlights quantifiable achievements that showcase operational improvements

- Mentions relevant technical skills that are important for the role of a mortgage underwriter

Pro Tip

Showcasing Your Work Experience

The work experience section is important for your resume as a mortgage underwriter, and it will contain the bulk of your information. Good resume templates are designed to emphasize this essential area to highlight your professional journey effectively.

This section should be organized in reverse-chronological order, where you clearly list your previous positions. Incorporate bullet points to draw attention to key achievements and responsibilities that showcase your skills in underwriting and risk assessment.

Now, let's review a couple of examples that demonstrate effective strategies for presenting your work history. These examples will help you identify what works well and areas that might benefit from adjustments.

Mortgage Underwriter

ABC Mortgage Company – Los Angeles, CA

- Reviewed loan applications

- Analyzed financial data

- Communicated with clients

- Made decisions on approvals

- Lacks specific employment dates for context

- Bullet points are overly general and do not highlight achievements

- Fails to mention any measurable outcomes or impact of the underwriting process

Mortgage Underwriter

National Bank of Commerce – Dallas, TX

March 2020 - Current

- Evaluate loan applications to assess risk factors, ensuring compliance with lending guidelines and resulting in a 30% reduction in default rates

- Collaborate with loan officers and clients to clarify documentation requirements, improving application turnaround time by 40%

- Mentor junior underwriters, improving team performance through training modules that focus on industry best practices

- Uses effective action verbs at the start of each bullet point to clearly showcase achievements

- Incorporates specific metrics that quantify success and improvements achieved in the role

- Highlights necessary skills relevant to mortgage underwriting while demonstrating overall contributions to the organization

While your resume summary and work experience are important components, don't overlook the significance of other sections, as each part contributes to presenting a complete picture of your qualifications. For more detailed guidance, explore our comprehensive guide on how to write a resume.

Top Skills to Include on Your Resume

A skills section is important for a mortgage underwriter's resume as it allows you to quickly highlight your qualifications. This section helps potential employers see that you possess the necessary expertise to excel in evaluating loan applications and assessing risk.

For this role, highlight both technical skills and interpersonal abilities. Emphasize proficiency with underwriting software like Encompass or Calyx, along with knowledge of financial analysis tools and regulatory compliance systems, while also showcasing communication and problem-solving skills that support effective decision-making.

Equally important are soft skills, which include strong communication, attention to detail, and problem-solving abilities that foster trust with clients and promote effective teamwork within lending institutions.

Selecting the right resume skills is important to align with what employers expect from job seekers. Many organizations use automated screening systems that filter out applicants lacking essential skills for the position.

To ensure your resume stands out, carefully review job postings related to your target role. They often highlight the specific skills that recruiters and ATS systems prioritize, guiding you to tailor your application effectively.

Pro Tip

10 skills that appear on successful mortgage underwriter resumes

Improving your resume with in-demand skills can greatly appeal to mortgage underwriter recruiters. You can explore our resume examples to see these important skills and qualifications, helping you confidently pursue job opportunities.

Here are 10 key skills you should consider incorporating into your resume if they align with your expertise and the job requirements:

Attention to detail

Analytical thinking

Risk assessment

Communication skills

Knowledge of mortgage regulations

Problem-solving abilities

Time management

Customer service orientation

Technical skill in underwriting software

Team collaboration

Based on analysis of 5,000+ real estate professional resumes from 2023-2024

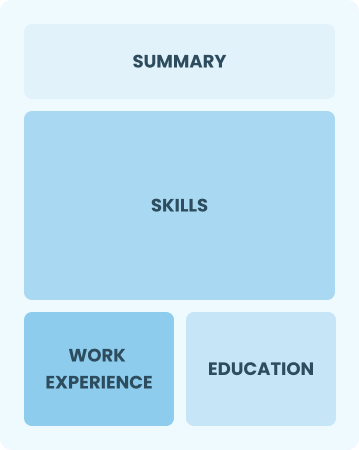

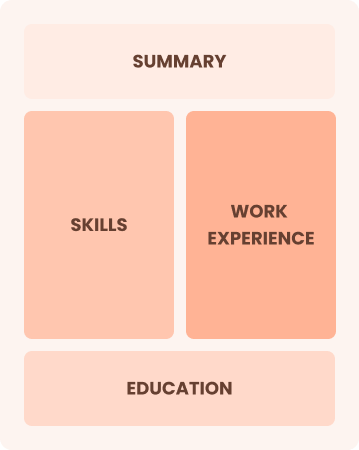

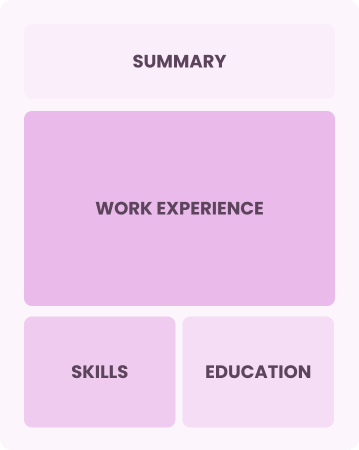

Resume Format Examples

Selecting the appropriate resume format for a mortgage underwriter is important, as it showcases your analytical skills and relevant experience, helping potential employers quickly recognize your qualifications and career growth.

Functional

Focuses on skills rather than previous jobs

Best for:

Recent graduates and career changers with limited experience in mortgage underwriting

Combination

Balances skills and work history equally

Best for:

Mid-career professionals eager to demonstrate their skills and pursue growth opportunities

Chronological

Emphasizes work history in reverse order

Best for:

Seasoned professionals leading complex mortgage assessments and risk analysis

Frequently Asked Questions

Should I include a cover letter with my mortgage underwriter resume?

Absolutely, including a cover letter can significantly improve your application. It offers a chance to highlight relevant skills and demonstrate your enthusiasm for the position. For tips on how to write a cover letter, explore our resources or use our Cover Letter Generator for quick assistance.

Can I use a resume if I’m applying internationally, or do I need a CV?

When applying for jobs internationally, a CV is often preferred over a resume. This is particularly true in Europe and Asia. To ensure your CV meets the expected standards, explore CV examples and tips for effective formatting and writing. Additionally, our resources offer guidance on how to write a CV that stands out.

What soft skills are important for mortgage underwriters?

Soft skills such as attention to detail, communication, and interpersonal skills are essential for mortgage underwriters. These abilities facilitate clear interactions with clients and colleagues, ensuring accurate assessments while fostering trust throughout the loan approval process.

I’m transitioning from another field. How should I highlight my experience?

Highlight your transferable skills such as attention to detail, analytical thinking, and effective communication from previous roles. These abilities showcase your potential value as a mortgage underwriter, even if your experience in finance is limited. Use specific scenarios that illustrate how you've successfully navigated complex situations to demonstrate your readiness for this role.

How should I format a cover letter for a mortgage underwriter job?

To format a cover letter for mortgage underwriter positions, start with your contact information. Follow this with a professional greeting and an engaging opening paragraph. Highlight skills and experiences relevant to the job description. Make sure to customize the content to reflect the specific requirements of the role. Conclude with a strong closing statement inviting further discussion.

Should I include a personal mission statement on my mortgage underwriter resume?

Yes, adding a personal mission statement to your resume can effectively showcase your dedication to responsible lending and financial integrity. This is especially beneficial when applying to companies that prioritize customer trust and ethical practices in their organizational culture.