Graduating Students Career Resource Center

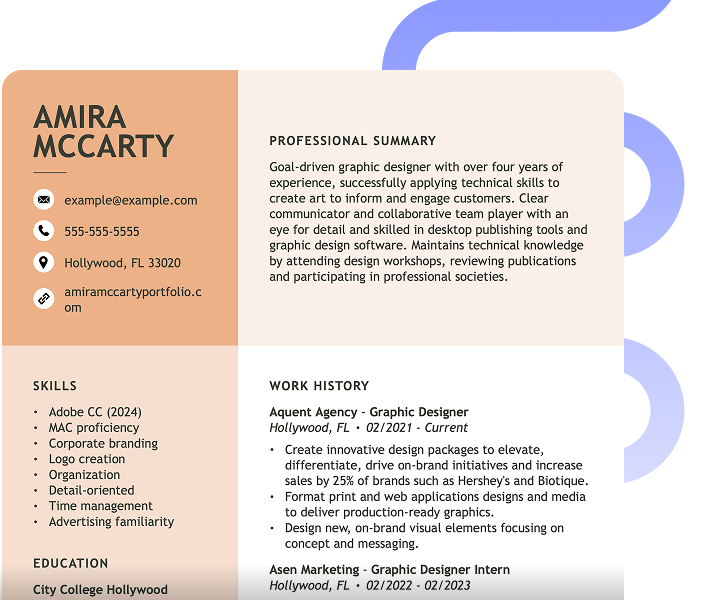

Our experts have researched the best tips across every phase of your job search journey, from finishing your degree to succeeding in your first job. You can also use our Resume Builder and Cover Letter Generator tools to help jumpstart your application materials!