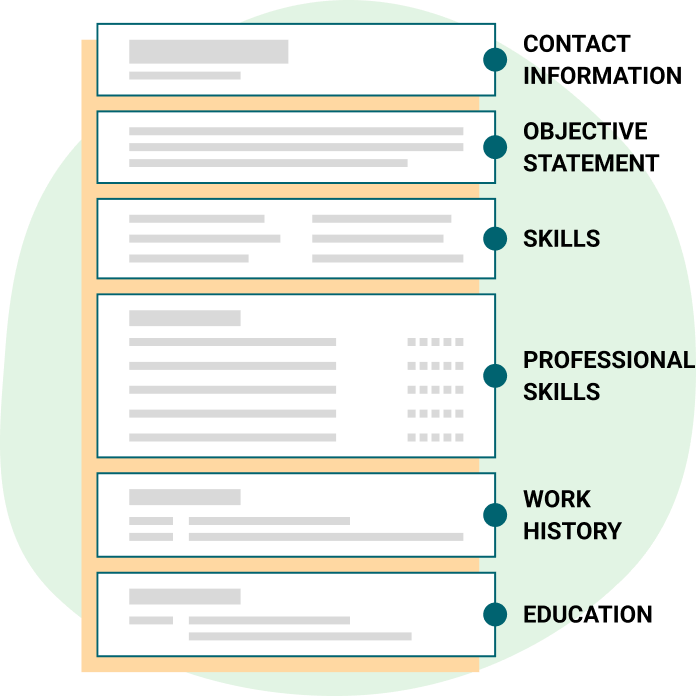

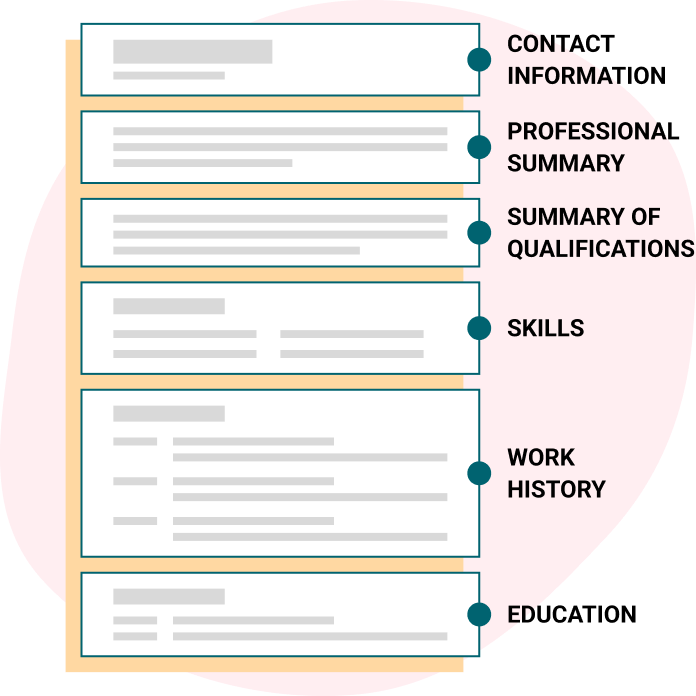

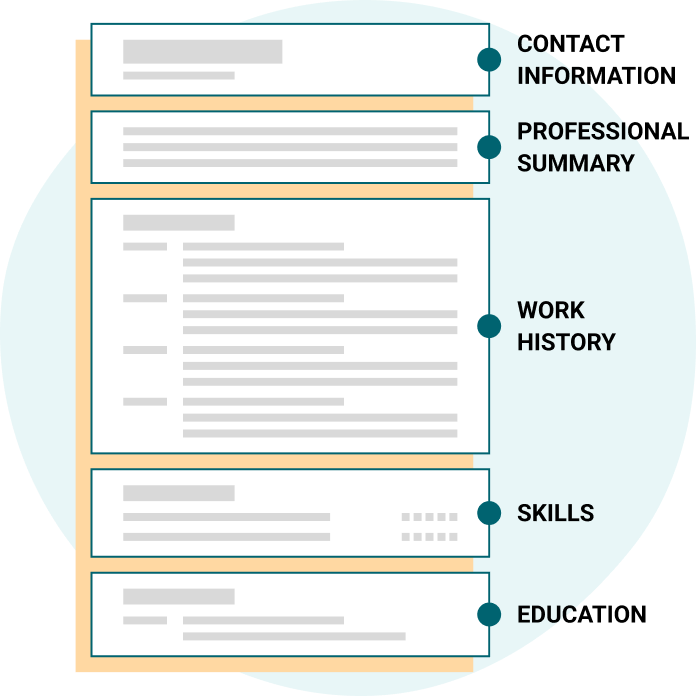

If you haven’t yet decided which resume format you’re going to use, now is the time to go back to the trader resume samples for help in deciding. Depending on your choice, the following are guidelines for writing the next section for each format:

If you’re writing a chronological style resume, the work experience section will follow your resume summary and will focus on your work history. This style works best for those with no employment gaps, and previous jobs should be listed in reverse chronological order, including the following information: job title, employer and location, period of employment, and 2-3 accomplishments performed for that employer.

Trader

Anderson and Hill Securities

February 2011 to February 2016

A typical job listing might look like this:

- Developed specialization in equity option bonds that provided a consistent advantage against less specialized traders

- Leveraged purchases to the client’s advantage

- Enlarged client base through referrals and networking events

If you’ve been in the industry for many years, it’s important to realize that employers usually consider just the last 15-20 years of employment to be relevant. By limiting your work history, you can avoid age discrimination that you would never be aware of.

If you’ve decided on the functional format because you have some employment gaps or you’re considering a move to a different industry sector, insert the accomplishments section between your resume summary and work experience sections.

Give careful thought to the 6-8 career accomplishments that will appeal to a potential employer. Refer once again to the job description, and as you compile this list, keep in mind that you don’t have to link your achievements to a specific employer, nor do you have to list them in date order. This will allow you to show the employer what they want to see in the order of importance based on the job description.

These bullet points should emphasize your agility, successes, and gains made for your employer and clients.

Once you’ve completed the accomplishments section, you can move on to the work experience section, which will now be a very slimmed-down list of previous jobs. Since there’s no need in this format to include dates, you’ll be able to avoid drawing attention to employment gaps.

The third option, the combination style, is your choice to incorporate the best of both formats. If you like the idea but you’re not sure how to do it, refer to the trader resume samples for inspiration.